Summary

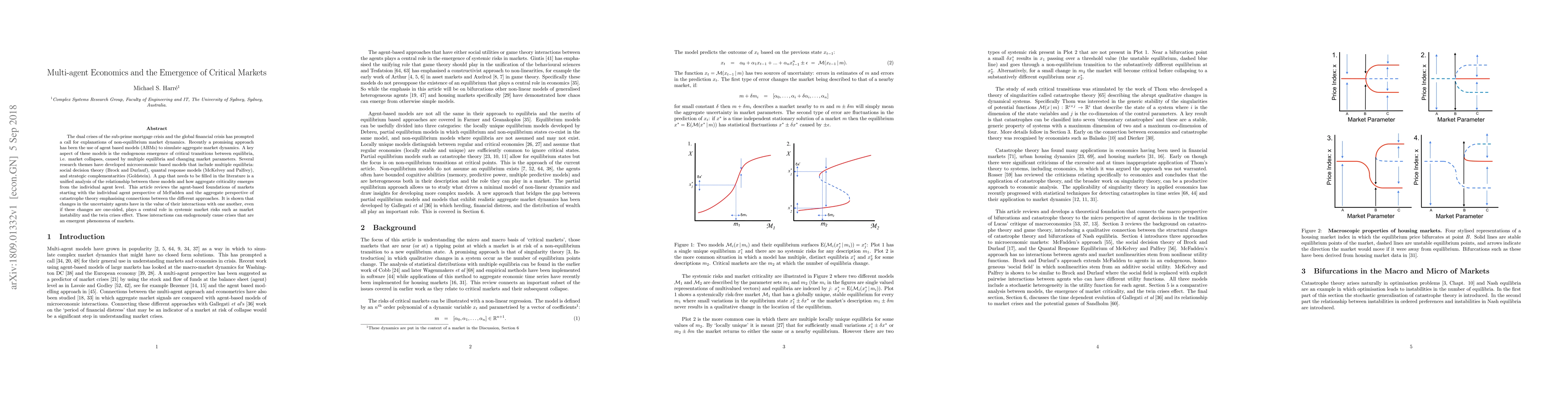

The dual crises of the sub-prime mortgage crisis and the global financial crisis has prompted a call for explanations of non-equilibrium market dynamics. Recently a promising approach has been the use of agent based models (ABMs) to simulate aggregate market dynamics. A key aspect of these models is the endogenous emergence of critical transitions between equilibria, i.e. market collapses, caused by multiple equilibria and changing market parameters. Several research themes have developed microeconomic based models that include multiple equilibria: social decision theory (Brock and Durlauf), quantal response models (McKelvey and Palfrey), and strategic complementarities (Goldstein). A gap that needs to be filled in the literature is a unified analysis of the relationship between these models and how aggregate criticality emerges from the individual agent level. This article reviews the agent-based foundations of markets starting with the individual agent perspective of McFadden and the aggregate perspective of catastrophe theory emphasising connections between the different approaches. It is shown that changes in the uncertainty agents have in the value of their interactions with one another, even if these changes are one-sided, plays a central role in systemic market risks such as market instability and the twin crises effect. These interactions can endogenously cause crises that are an emergent phenomena of markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersModelling crypto markets by multi-agent reinforcement learning

Stefano Palminteri, Boris Gutkin, Johann Lussange et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)