Summary

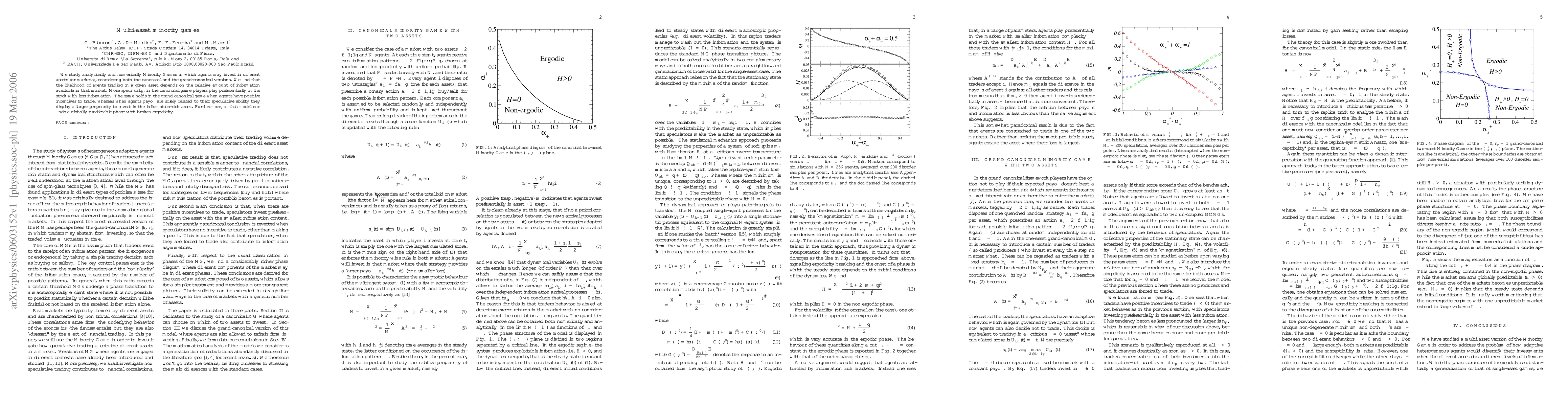

We study analytically and numerically Minority Games in which agents may invest in different assets (or markets), considering both the canonical and the grand-canonical versions. We find that the likelihood of agents trading in a given asset depends on the relative amount of information available in that market. More specifically, in the canonical game players play preferentially in the stock with less information. The same holds in the grand canonical game when agents have positive incentives to trade, whereas when agents payoff are solely related to their speculative ability they display a larger propensity to invest in the information-rich asset. Furthermore, in this model one finds a globally predictable phase with broken ergodicity.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Comments (0)