Summary

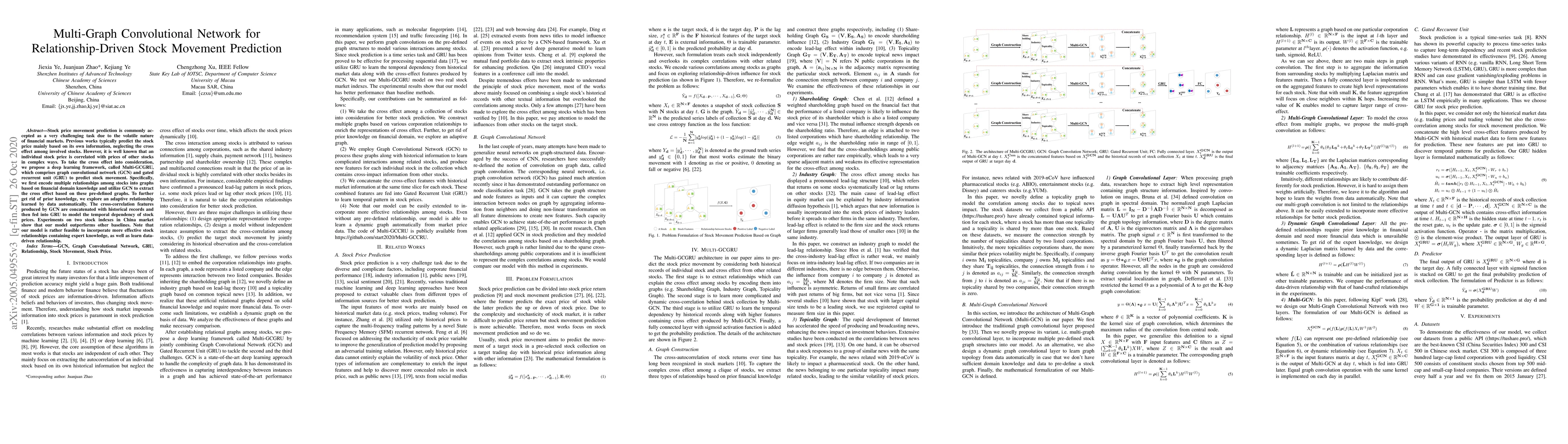

Stock price movement prediction is commonly accepted as a very challenging task due to the volatile nature of financial markets. Previous works typically predict the stock price mainly based on its own information, neglecting the cross effect among involved stocks. However, it is well known that an individual stock price is correlated with prices of other stocks in complex ways. To take the cross effect into consideration, we propose a deep learning framework, called Multi-GCGRU, which comprises graph convolutional network (GCN) and gated recurrent unit (GRU) to predict stock movement. Specifically, we first encode multiple relationships among stocks into graphs based on financial domain knowledge and utilize GCN to extract the cross effect based on these pre-defined graphs. To further get rid of prior knowledge, we explore an adaptive relationship learned by data automatically. The cross-correlation features produced by GCN are concatenated with historical records and then fed into GRU to model the temporal dependency of stock prices. Experiments on two stock indexes in China market show that our model outperforms other baselines. Note that our model is rather feasible to incorporate more effective stock relationships containing expert knowledge, as well as learn data-driven relationship.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersGCNET: graph-based prediction of stock price movement using graph convolutional network

Alireza Jafari, Saman Haratizadeh

CausalStock: Deep End-to-end Causal Discovery for News-driven Stock Movement Prediction

Rui Yan, Xin Gao, Shuo Shang et al.

ChatGPT Informed Graph Neural Network for Stock Movement Prediction

Zihan Chen, Cheng Lu, Di Zhu et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)