Summary

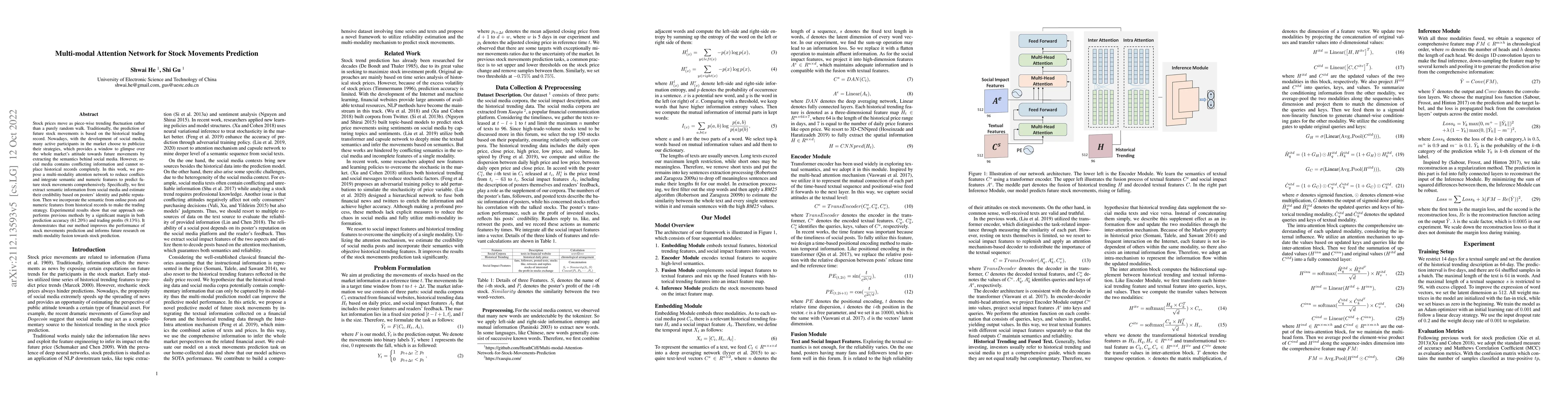

Stock prices move as piece-wise trending fluctuation rather than a purely random walk. Traditionally, the prediction of future stock movements is based on the historical trading record. Nowadays, with the development of social media, many active participants in the market choose to publicize their strategies, which provides a window to glimpse over the whole market's attitude towards future movements by extracting the semantics behind social media. However, social media contains conflicting information and cannot replace historical records completely. In this work, we propose a multi-modality attention network to reduce conflicts and integrate semantic and numeric features to predict future stock movements comprehensively. Specifically, we first extract semantic information from social media and estimate their credibility based on posters' identity and public reputation. Then we incorporate the semantic from online posts and numeric features from historical records to make the trading strategy. Experimental results show that our approach outperforms previous methods by a significant margin in both prediction accuracy (61.20\%) and trading profits (9.13\%). It demonstrates that our method improves the performance of stock movements prediction and informs future research on multi-modality fusion towards stock prediction.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersVariational Multi-Modal Hypergraph Attention Network for Multi-Modal Relation Extraction

Shangguang Wang, Qian Li, Yong Zhao et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)