Summary

We consider a multi-objective risk-averse two-stage stochastic programming problem with a multivariate convex risk measure. We suggest a convex vector optimization formulation with set-valued constraints and propose an extended version of Benson's algorithm to solve this problem. Using Lagrangian duality, we develop scenario-wise decomposition methods to solve the two scalarization problems appearing in Benson's algorithm. Then, we propose a procedure to recover the primal solutions of these scalarization problems from the solutions of their Lagrangian dual problems. Finally, we test our algorithms on a multi-asset portfolio optimization problem under transaction costs.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

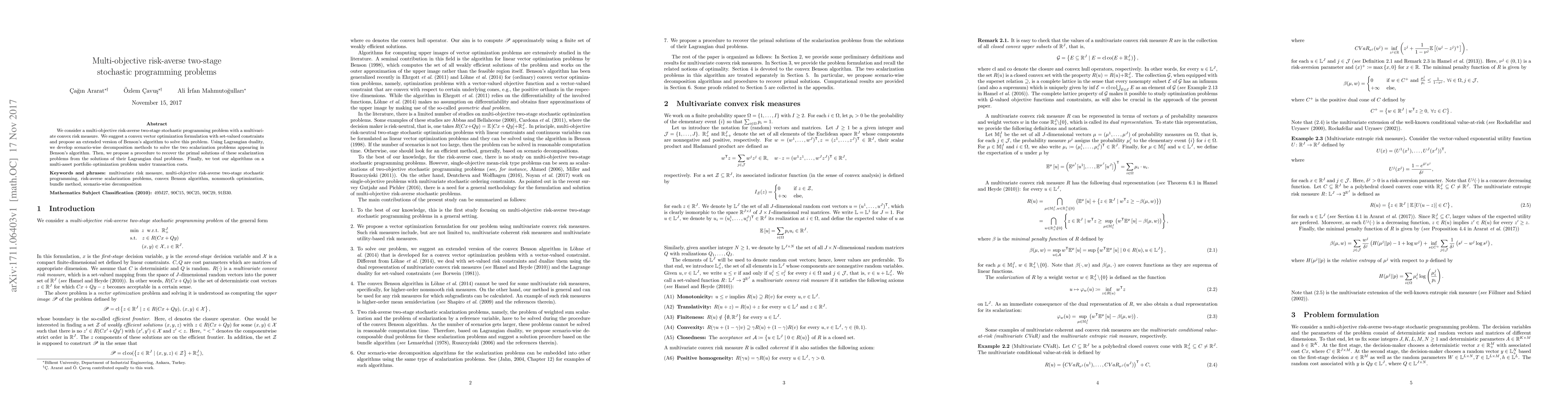

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOn the Value of Risk-Averse Multistage Stochastic Programming in Capacity Planning

Xian Yu, Siqian Shen

Expectiles In Risk Averse Stochastic Programming and Dynamic Optimization

Rajmadan Lakshmanan, Alois Pichler

| Title | Authors | Year | Actions |

|---|

Comments (0)