Summary

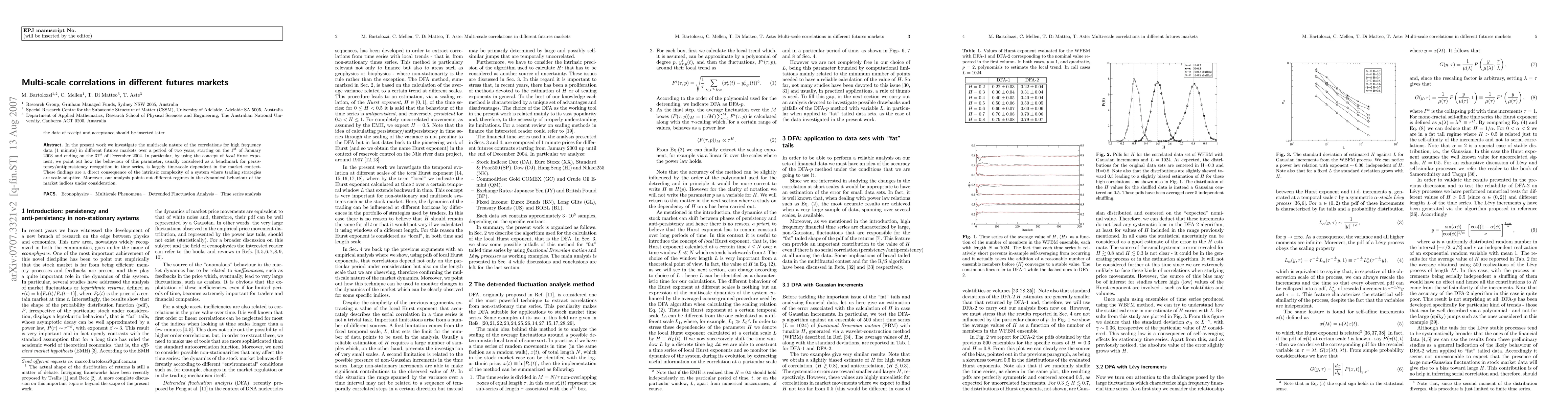

In the present work we investigate the multiscale nature of the correlations for high frequency data (1 minute) in different futures markets over a period of two years, starting on the 1st of January 2003 and ending on the 31st of December 2004. In particular, by using the concept of "local" Hurst exponent, we point out how the behaviour of this parameter, usually considered as a benchmark for persistency/antipersistency recognition in time series, is largely time-scale dependent in the market context. These findings are a direct consequence of the intrinsic complexity of a system where trading strategies are scale-adaptive. Moreover, our analysis points out different regimes in the dynamical behaviour of the market indices under consideration.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAI-driven multi-omics integration for multi-scale predictive modeling of causal genotype-environment-phenotype relationships

Lei Xie, You Wu

HiT-SR: Hierarchical Transformer for Efficient Image Super-Resolution

Xiang Zhang, Yulun Zhang, Fisher Yu

| Title | Authors | Year | Actions |

|---|

Comments (0)