Summary

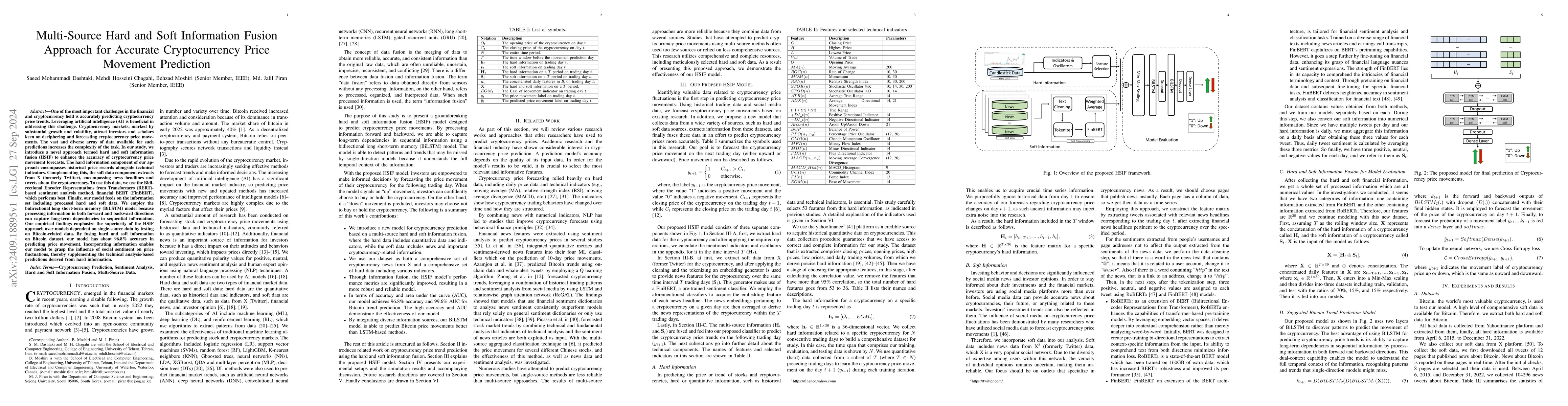

One of the most important challenges in the financial and cryptocurrency field is accurately predicting cryptocurrency price trends. Leveraging artificial intelligence (AI) is beneficial in addressing this challenge. Cryptocurrency markets, marked by substantial growth and volatility, attract investors and scholars keen on deciphering and forecasting cryptocurrency price movements. The vast and diverse array of data available for such predictions increases the complexity of the task. In our study, we introduce a novel approach termed hard and soft information fusion (HSIF) to enhance the accuracy of cryptocurrency price movement forecasts. The hard information component of our approach encompasses historical price records alongside technical indicators. Complementing this, the soft data component extracts from X (formerly Twitter), encompassing news headlines and tweets about the cryptocurrency. To use this data, we use the Bidirectional Encoder Representations from Transformers (BERT)-based sentiment analysis method, financial BERT (FinBERT), which performs best. Finally, our model feeds on the information set including processed hard and soft data. We employ the bidirectional long short-term memory (BiLSTM) model because processing information in both forward and backward directions can capture long-term dependencies in sequential information. Our empirical findings emphasize the superiority of the HSIF approach over models dependent on single-source data by testing on Bitcoin-related data. By fusing hard and soft information on Bitcoin dataset, our model has about 96.8\% accuracy in predicting price movement. Incorporating information enables our model to grasp the influence of social sentiment on price fluctuations, thereby supplementing the technical analysis-based predictions derived from hard information.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCross Cryptocurrency Relationship Mining for Bitcoin Price Prediction

Qi Xuan, Jiajun Zhou, Shengbo Gong et al.

Cryptocurrency Price Prediction using Twitter Sentiment Analysis

Haritha GB, Sahana N. B

Accurate prediction of synergistic drug combination using a multi-source information fusion framework.

Yu, Xuan, Xu, Junlin, Jin, Shuting et al.

No citations found for this paper.

Comments (0)