Summary

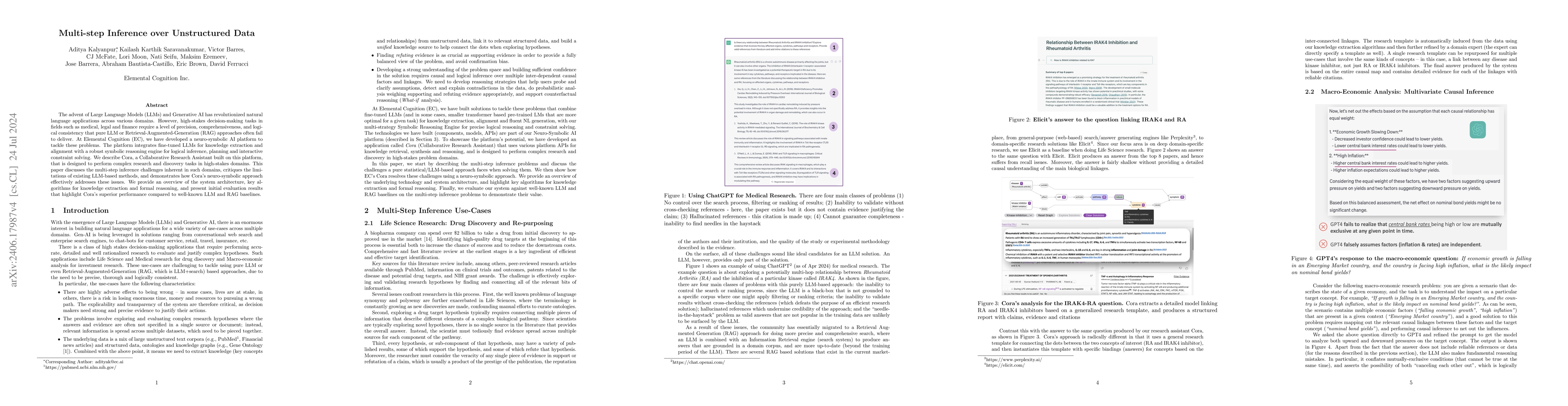

The advent of Large Language Models (LLMs) and Generative AI has revolutionized natural language applications across various domains. However, high-stakes decision-making tasks in fields such as medical, legal and finance require a level of precision, comprehensiveness, and logical consistency that pure LLM or Retrieval-Augmented-Generation (RAG) approaches often fail to deliver. At Elemental Cognition (EC), we have developed a neuro-symbolic AI platform to tackle these problems. The platform integrates fine-tuned LLMs for knowledge extraction and alignment with a robust symbolic reasoning engine for logical inference, planning and interactive constraint solving. We describe Cora, a Collaborative Research Assistant built on this platform, that is designed to perform complex research and discovery tasks in high-stakes domains. This paper discusses the multi-step inference challenges inherent in such domains, critiques the limitations of existing LLM-based methods, and demonstrates how Cora's neuro-symbolic approach effectively addresses these issues. We provide an overview of the system architecture, key algorithms for knowledge extraction and formal reasoning, and present preliminary evaluation results that highlight Cora's superior performance compared to well-known LLM and RAG baselines.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersInference for Regression with Variables Generated from Unstructured Data

Laura Battaglia, Timothy Christensen, Stephen Hansen et al.

A Unifying Framework for Robust and Efficient Inference with Unstructured Data

Melissa Dell, Jacob Carlson

Cross Modal Data Discovery over Structured and Unstructured Data Lakes

Mohamed Y. Eltabakh, Mohammad Shahmeer Ahmad, Ahmed Elmagarmid et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)