Summary

This paper deals with multidimensional dynamic risk measures induced by conditional $g$-expectations. A notion of multidimensional $g$-expectation is proposed to provide a multidimensional version of nonlinear expectations. By a technical result on explicit expressions for the comparison theorem, uniqueness theorem and viability on a rectangle of solutions to multidimensional backward stochastic differential equations, some necessary and sufficient conditions are given for the constancy, monotonicity, positivity, homogeneity and translatability properties of multidimensional conditional $g$-expectations and multidimensional dynamic risk measures; we prove that a multidimensional dynamic $g$-risk measure is nonincreasingly convex if and only if the generator $g$ satisfies a quasi-monotone increasingly convex condition. A general dual representation is given for the multidimensional dynamic convex $g$-risk measure in which the penalty term is expressed more precisely. It is shown that model uncertainty leads to the convexity of risk measures. As to applications, we show how this multidimensional approach can be applied to measure the insolvency risk of a firm with interacted subsidiaries; optimal risk sharing for $\protect\gamma $-tolerant $g$-risk measures is investigated. Insurance $g$-risk measure and other ways to induce $g$-risk measures are also studied at the end of the paper.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

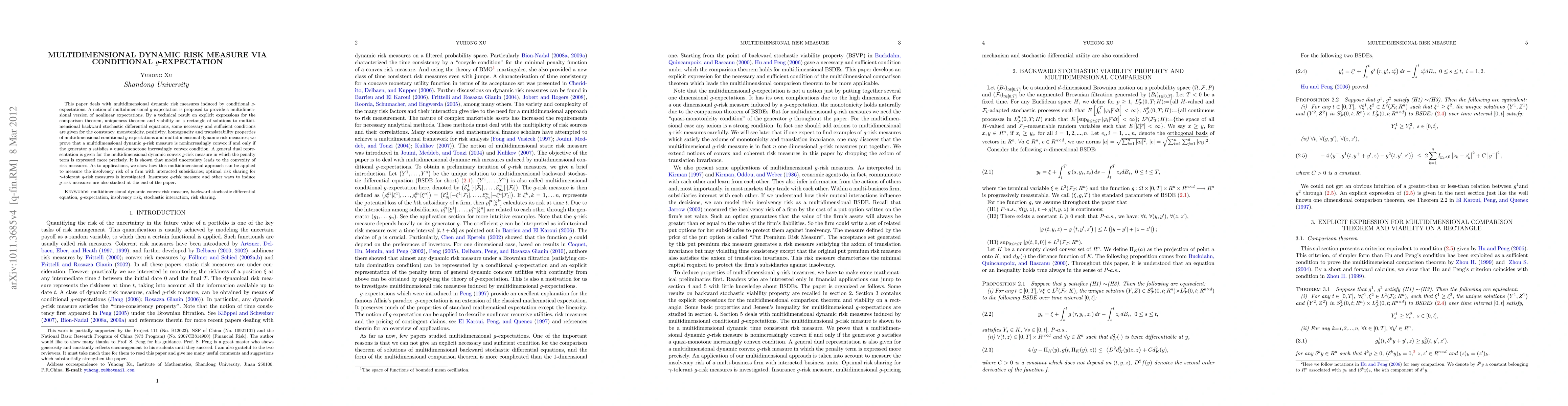

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA bang-bang principle for the conditional expectation vector measure

Mohammed Sbihi, Youcef Askoura

| Title | Authors | Year | Actions |

|---|

Comments (0)