Summary

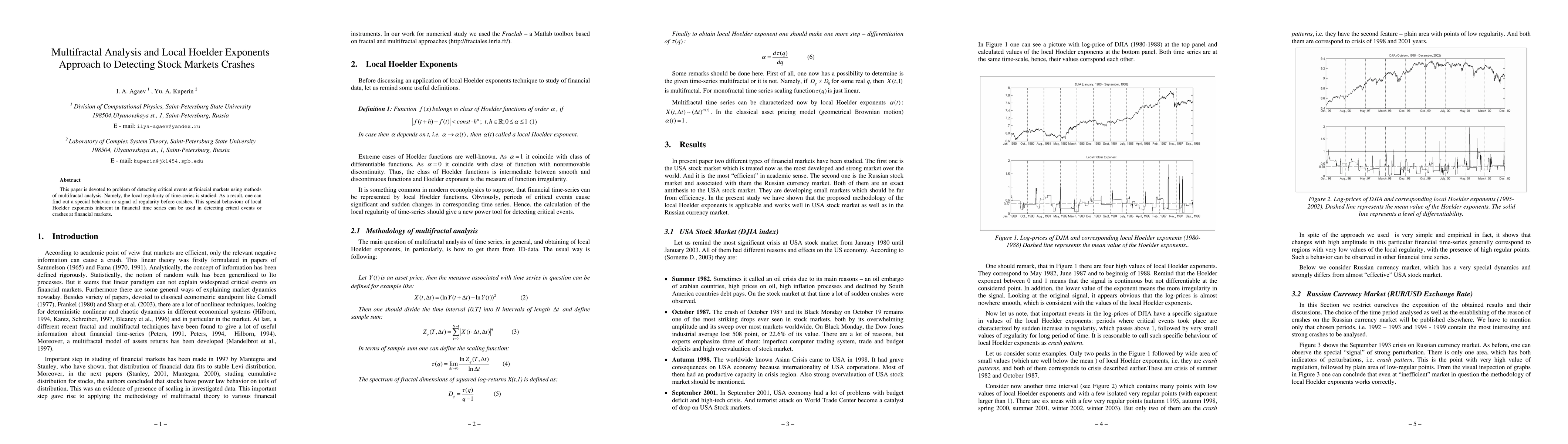

This paper is devoted to problem of detecting critical events at finiacial markets using methods of multifractal analysis. Namely, the local regularity of time-series is studied. As a result, one can find out a special behavior or signal of regularity before crashes. This spesial behaviour of local Hoelder exponents inherent in financial time series can be used in detecting critcal events or crashes at financial markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Comments (0)