Summary

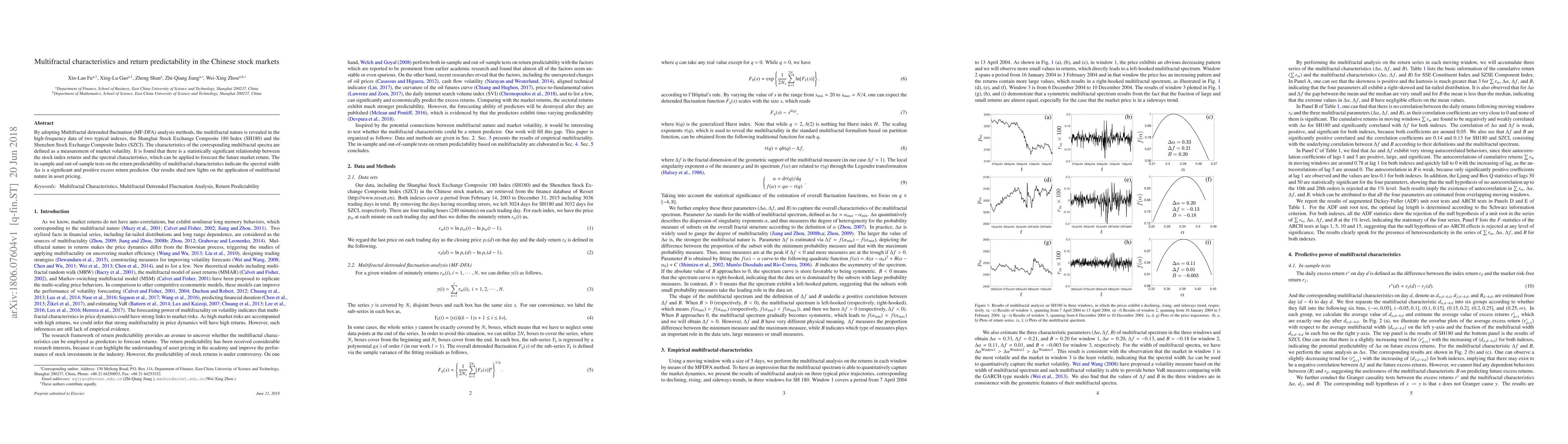

By adopting Multifractal detrended fluctuation (MF-DFA) analysis methods, the multifractal nature is revealed in the high-frequency data of two typical indexes, the Shanghai Stock Exchange Composite 180 Index (SH180) and the Shenzhen Stock Exchange Composite Index (SZCI). The characteristics of the corresponding multifractal spectra are defined as a measurement of market volatility. It is found that there is a statistically significant relationship between the stock index returns and the spectral characteristics, which can be applied to forecast the future market return. The in-sample and out-of-sample tests on the return predictability of multifractal characteristics indicate the spectral width $\Delta {\alpha}$ is a significant and positive excess return predictor. Our results shed new lights on the application of multifractal nature in asset pricing.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)