Summary

We propose a multifractal model for short-term interest rates. The model is a version of the Markov-Switching Multifractal (MSM), which incorporates the well-known level effect observed in interest rates. Unlike previously suggested models, the level-MSM model captures the power-law scaling of the structure functions and the slowly decaying dependency in the absolute value of returns. We apply the model to the Norwegian Interbank Offered Rate with three months maturity (NIBORM3) and the U.S. Treasury Bill with three months maturity (TBM3). The performance of the model is compared to level-GARCH models, level-EGARCH models and jump-diffusions. For the TBM3 data the multifractal out-performs all the alternatives considered.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

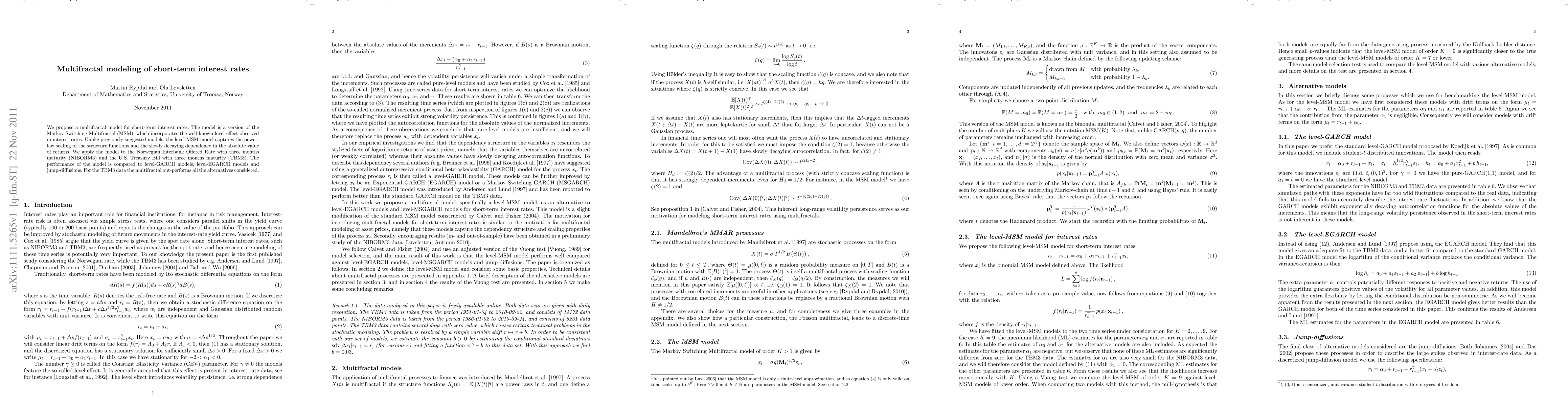

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersGraph Based Long-Term And Short-Term Interest Model for Click-Through Rate Prediction

Bo Zhang, Dong Wang, Xingxing Wang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)