Summary

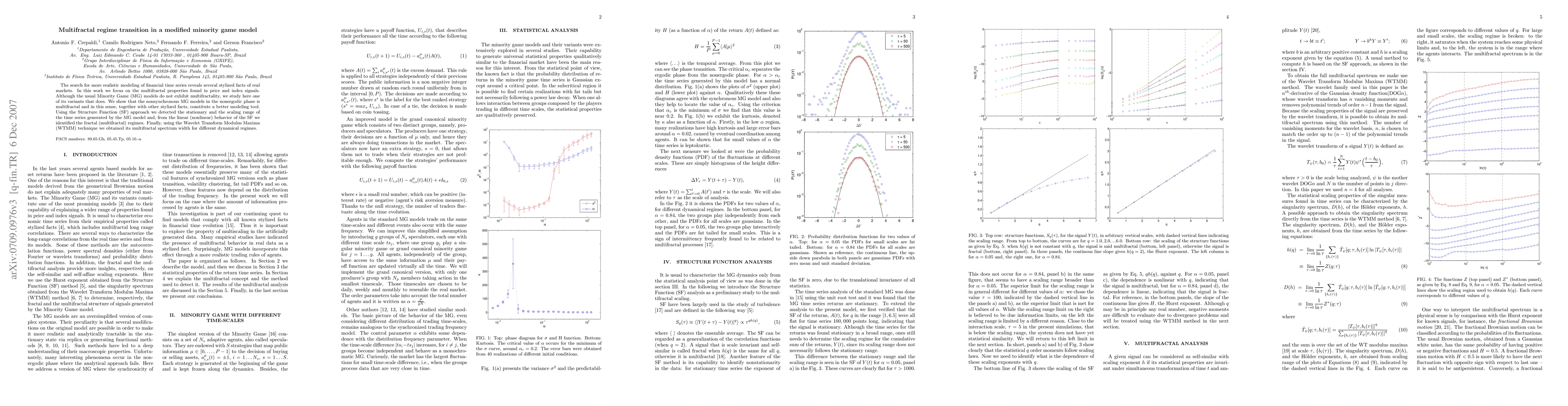

The search for more realistic modeling of financial time series reveals several stylized facts of real markets. In this work we focus on the multifractal properties found in price and index signals. Although the usual Minority Game (MG) models do not exhibit multifractality, we study here one of its variants that does. We show that the nonsynchronous MG models in the nonergodic phase is multifractal and in this sense, together with other stylized facts, constitute a better modeling tool. Using the Structure Function (SF) approach we detected the stationary and the scaling range of the time series generated by the MG model and, from the linear (nonlinear) behavior of the SF we identified the fractal (multifractal) regimes. Finally, using the Wavelet Transform Modulus Maxima (WTMM) technique we obtained its multifractal spectrum width for different dynamical regimes.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)