Summary

Multilayer networks are attracting growing attention in many fields, including finance. In this paper, we develop a new tractable procedure for multilayer aggregation based on statistical validation, which we apply to investor networks. Moreover, we propose two other improvements to their analysis: transaction bootstrapping and investor categorization. The aggregation procedure can be used to integrate security-wise and time-wise information about investor trading networks, but it is not limited to finance. In fact, it can be used for different applications, such as gene, transportation, and social networks, were they inferred or observable. Additionally, in the investor network inference, we use transaction bootstrapping for better statistical validation. Investor categorization allows for constant size networks and having more observations for each node, which is important in the inference especially for less liquid securities. Furthermore, we observe that the window size used for averaging has a substantial effect on the number of inferred relationships. We apply this procedure by analyzing a unique data set of Finnish shareholders during the period 2004-2009. We find that households in the capital have high centrality in investor networks, which, under the theory of information channels in investor networks suggests that they are well-informed investors.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

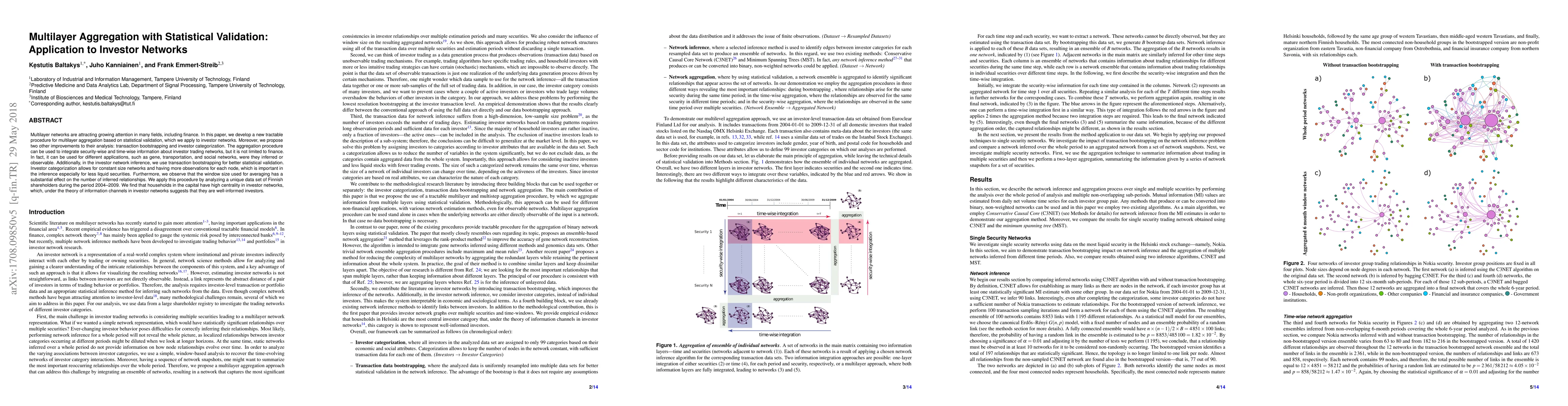

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)