Authors

Summary

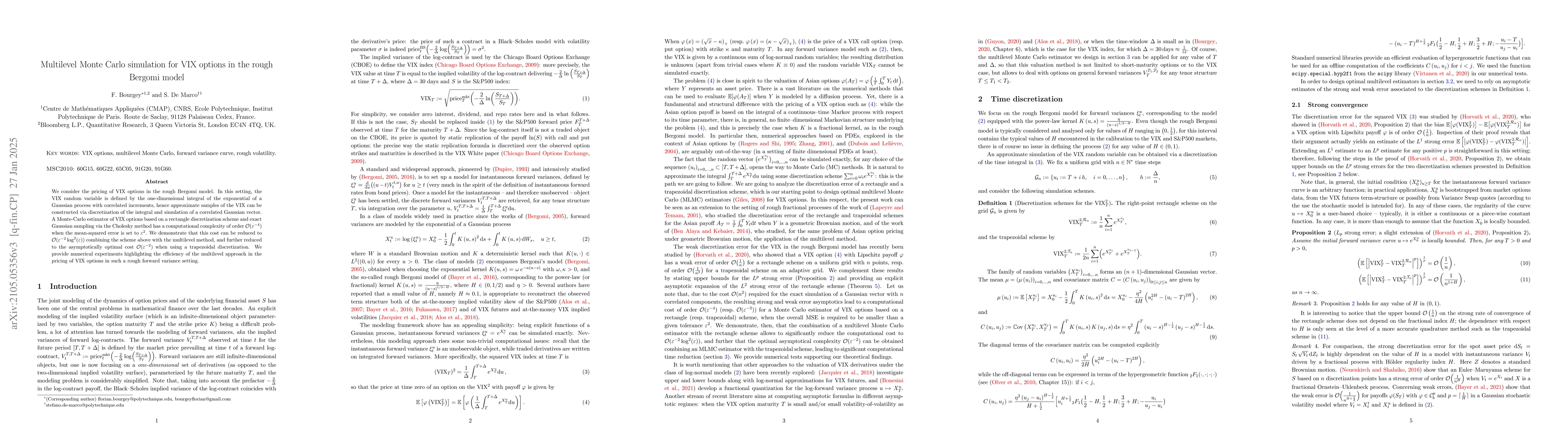

We consider the pricing of VIX options in the rough Bergomi model. In this setting, the VIX random variable is defined by the one-dimensional integral of the exponential of a Gaussian process with correlated increments, hence approximate samples of the VIX can be constructed via discretization of the integral and simulation of a correlated Gaussian vector. A Monte-Carlo estimator of VIX options based on a rectangle discretization scheme and exact Gaussian sampling via the Cholesky method has a computational complexity of order $\mathcal{O}(\varepsilon^{-4})$ when the mean-squared error is set to $\varepsilon^2$. We demonstrate that this cost can be reduced to $\mathcal{O}(\varepsilon^{-2} \log^2(\varepsilon))$ combining the scheme above with the multilevel method, and further reduced to the asymptotically optimal cost $\mathcal{O}(\varepsilon^{-2})$ when using a trapezoidal discretization. We provide numerical experiments highlighting the efficiency of the multilevel approach in the pricing of VIX options in such a rough forward variance setting.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRough multifactor volatility for SPX and VIX options

Antoine Jacquier, Aitor Muguruza, Alexandre Pannier

| Title | Authors | Year | Actions |

|---|

Comments (0)