Summary

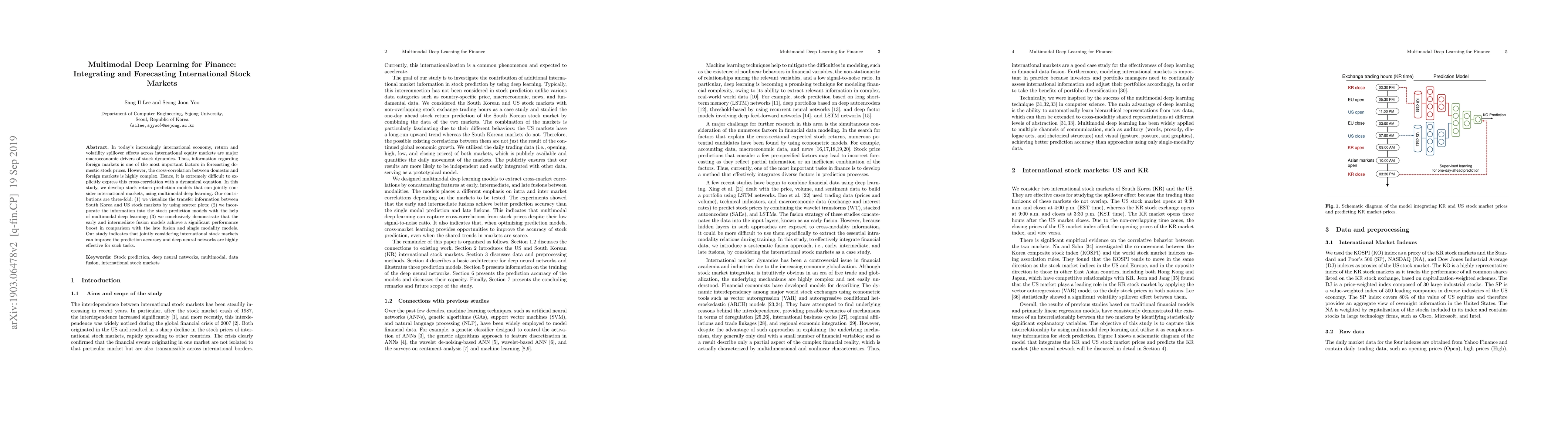

In today's increasingly international economy, return and volatility spillover effects across international equity markets are major macroeconomic drivers of stock dynamics. Thus, information regarding foreign markets is one of the most important factors in forecasting domestic stock prices. However, the cross-correlation between domestic and foreign markets is highly complex. Hence, it is extremely difficult to explicitly express this cross-correlation with a dynamical equation. In this study, we develop stock return prediction models that can jointly consider international markets, using multimodal deep learning. Our contributions are three-fold: (1) we visualize the transfer information between South Korea and US stock markets by using scatter plots; (2) we incorporate the information into the stock prediction models with the help of multimodal deep learning; (3) we conclusively demonstrate that the early and intermediate fusion models achieve a significant performance boost in comparison with the late fusion and single modality models. Our study indicates that jointly considering international stock markets can improve the prediction accuracy and deep neural networks are highly effective for such tasks.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNews-Driven Stock Price Forecasting in Indian Markets: A Comparative Study of Advanced Deep Learning Models

Mukesh Tripathi, Kaushal Attaluri, Srinithi Reddy et al.

FinRL: A Deep Reinforcement Learning Library for Automated Stock Trading in Quantitative Finance

Qian Chen, Liuqing Yang, Xiao-Yang Liu et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)