Authors

Summary

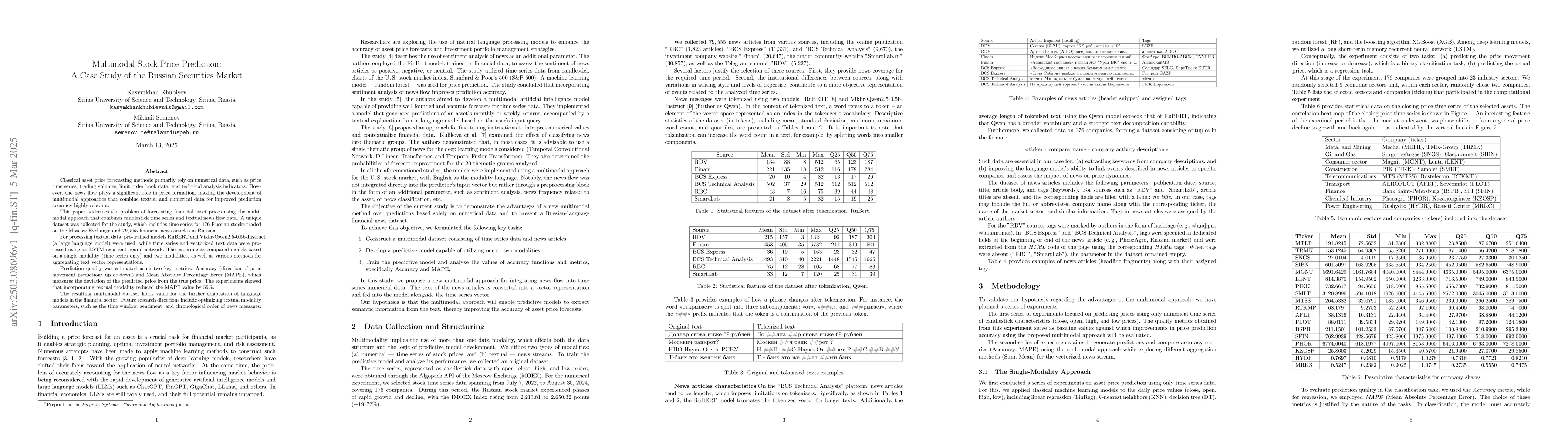

Classical asset price forecasting methods primarily rely on numerical data, such as price time series, trading volumes, limit order book data, and technical analysis indicators. However, the news flow plays a significant role in price formation, making the development of multimodal approaches that combine textual and numerical data for improved prediction accuracy highly relevant. This paper addresses the problem of forecasting financial asset prices using the multimodal approach that combines candlestick time series and textual news flow data. A unique dataset was collected for the study, which includes time series for 176 Russian stocks traded on the Moscow Exchange and 79,555 financial news articles in Russian. For processing textual data, pre-trained models RuBERT and Vikhr-Qwen2.5-0.5b-Instruct (a large language model) were used, while time series and vectorized text data were processed using an LSTM recurrent neural network. The experiments compared models based on a single modality (time series only) and two modalities, as well as various methods for aggregating text vector representations. Prediction quality was estimated using two key metrics: Accuracy (direction of price movement prediction: up or down) and Mean Absolute Percentage Error (MAPE), which measures the deviation of the predicted price from the true price. The experiments showed that incorporating textual modality reduced the MAPE value by 55%. The resulting multimodal dataset holds value for the further adaptation of language models in the financial sector. Future research directions include optimizing textual modality parameters, such as the time window, sentiment, and chronological order of news messages.

AI Key Findings

Generated Jun 10, 2025

Methodology

This study collects a unique dataset of 176 Russian stocks from the Moscow Exchange and 79,555 Russian financial news articles. It employs pre-trained models RuBERT and Vikhr-Qwen2.5-0.5b-Instruct for textual data, and LSTM recurrent neural networks for time series and vectorized text data. The models are evaluated using Accuracy (direction of price movement prediction) and Mean Absolute Percentage Error (MAPE) metrics.

Key Results

- Incorporating textual modality reduced MAPE value by 55% compared to models using only time series data.

- The dual-modality approach outperformed the single-modality model, demonstrating improved price prediction accuracy.

- The averaging method (Mean) for aggregating news vectors performed better than summation (Sum).

Significance

This research is significant as it highlights the importance of combining textual news flow data with numerical time series data for enhanced stock price prediction accuracy, particularly relevant for the Russian securities market.

Technical Contribution

The paper presents a multimodal approach for stock price prediction that integrates candlestick time series and textual news flow data, utilizing pre-trained Russian language models and LSTM networks.

Novelty

The novelty of this work lies in its focus on the Russian securities market, application of large language models for financial text data, and comprehensive evaluation of multimodal approaches for stock price prediction.

Limitations

- The dataset is specific to the Russian securities market, limiting generalizability to other markets.

- The study did not extensively explore the impact of varying time windows for news data incorporation.

Future Work

- Investigate the impact of different time windows for news messages on prediction quality.

- Optimize textual modality parameters, such as sentiment analysis and chronological order of news messages.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTransformer-Based Deep Learning Model for Stock Price Prediction: A Case Study on Bangladesh Stock Market

Mohammad Shafiul Alam, Muhammad Ibrahim, Tashreef Muhammad et al.

Multimodal Stock Price Prediction

Furkan Karadaş, Bahaeddin Eravcı, Ahmet Murat Özbayoğlu

The Predictability of Stock Price: Empirical Study onTick Data in Chinese Stock Market

Tian Lan, Xingyu Xu, Sihai Zhang et al.

Stock Market Price Prediction: A Hybrid LSTM and Sequential Self-Attention based Approach

Ahmed M. Abdelmoniem, Sukhpal Singh Gill, Karan Pardeshi

No citations found for this paper.

Comments (0)