Summary

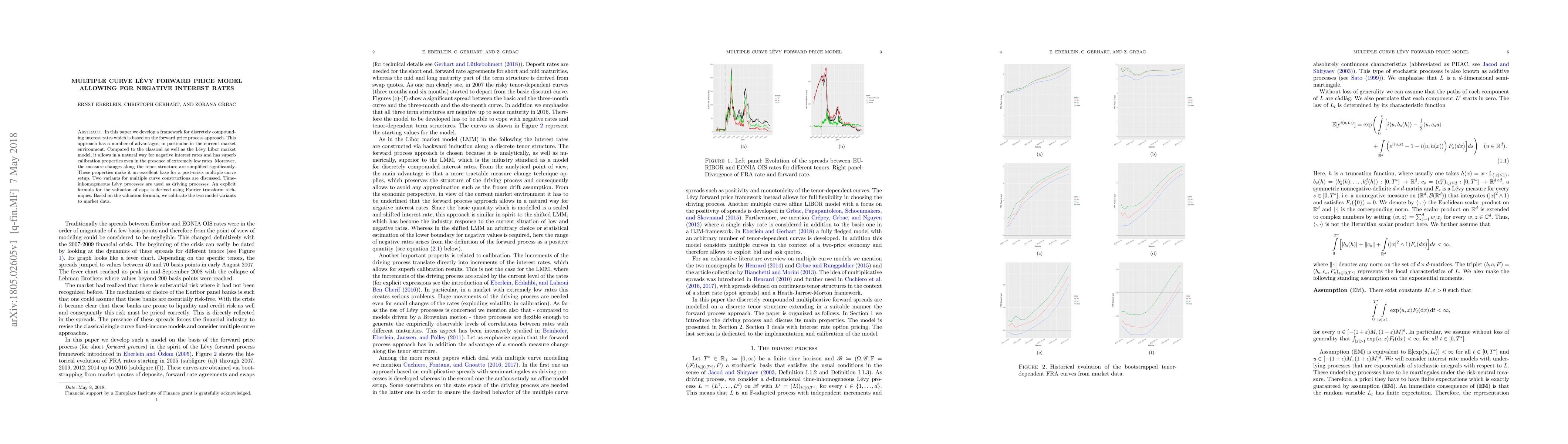

In this paper we develop a framework for discretely compounding interest rates which is based on the forward price process approach. This approach has a number of advantages, in particular in the current market environment. Compared to the classical as well as the L\'evy Libor market model, it allows in a natural way for negative interest rates and has superb calibration properties even in the presence of extremely low rates. Moreover, the measure changes along the tenor structure are simplified significantly. These properties make it an excellent base for a post-crisis multiple curve setup. Two variants for multiple curve constructions are discussed. Time-inhomogeneous L\'evy processes are used as driving processes. An explicit formula for the valuation of caps is derived using Fourier transform techniques. Based on the valuation formula, we calibrate the two model variants to market data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)