Summary

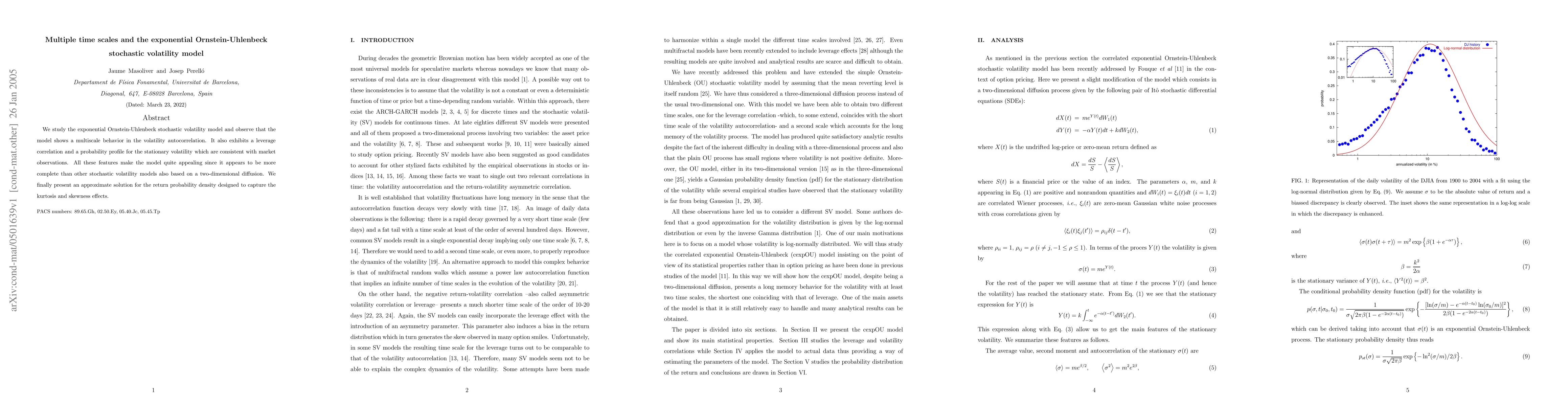

We study the exponential Ornstein-Uhlenbeck stochastic volatility model and observe that the model shows a multiscale behavior in the volatility autocorrelation. It also exhibits a leverage correlation and a probability profile for the stationary volatility which are consistent with market observations. All these features make the model quite appealing since it appears to be more complete than other stochastic volatility models also based on a two-dimensional diffusion. We finally present an approximate solution for the return probability density designed to capture the kurtosis and skewness effects.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOn the entropy minimal martingale measure in the exponential Ornstein-Uhlenbeck stochastic volatility model

Yuri Kabanov, Mikhail A. Sonin

| Title | Authors | Year | Actions |

|---|

Comments (0)