Summary

In this paper, the relevance of the Feller conditions in discrete time macro-finance term structure models is investigated. The Feller conditions are usually imposed on a continuous time multivariate square root process to ensure that the roots have nonnegative arguments. For a discrete time approximate model, the Feller conditions do not give this guarantee. Moreover, in a macro-finance context the restrictions imposed might be economically unappealing. At the same time, it has also been observed that even without the Feller conditions imposed, for a practically relevant term structure model, negative arguments rarely occur. Using models estimated on German data, we compare the yields implied by (approximate) analytic exponentially affine expressions to those obtained through Monte Carlo simulations of very high numbers of sample paths. It turns out that the differences are rarely statistically significant, whether the Feller conditions are imposed or not. Moreover, economically the differences are negligible, as they are always below one basis point.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

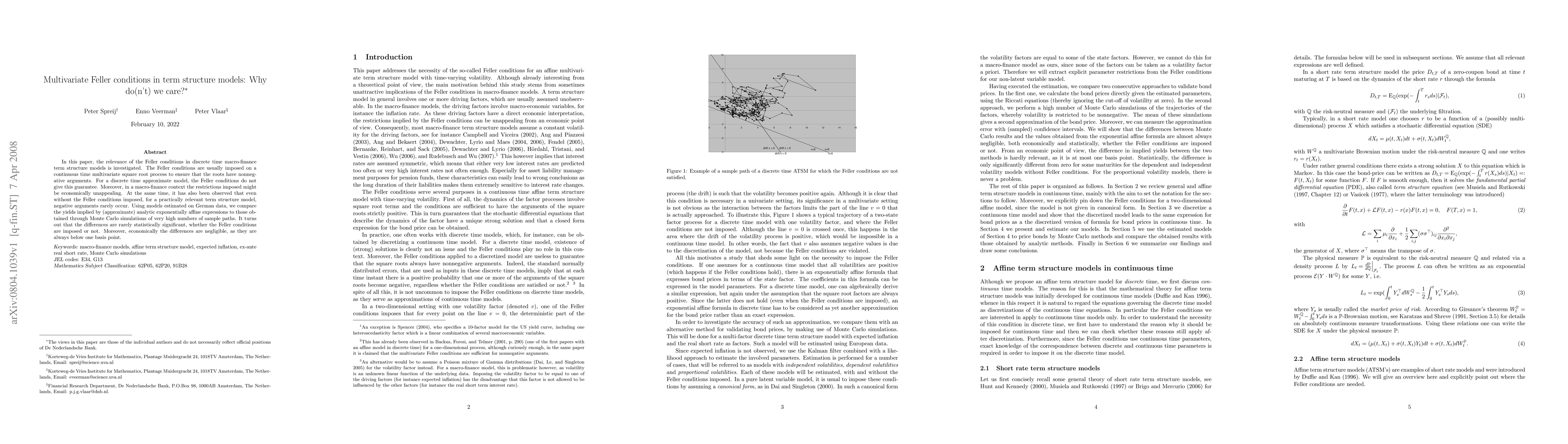

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)