Authors

Summary

In this paper we propose a multivariate ordinal regression model which allows the joint modeling of three-dimensional panel data containing both repeated and multiple measurements for a collection of subjects. This is achieved by a multivariate autoregressive structure on the errors of the latent variables underlying the ordinal responses, where we distinguish between the correlations at a single point in time and the persistence over time. The error distribution is assumed to be normal or Student t distributed. The estimation is performed using composite likelihood methods. We perform several simulation exercises to investigate the quality of the estimates in different settings as well as in comparison with a Bayesian approach. The simulation study confirms that the estimation procedure is able to recover the model parameters well and is competitive in terms of computation time. We also introduce R package mvordflex and illustrate how this implementation can be used to estimate the proposed model in a user-friendly, convenient way. Finally, we illustrate the framework on a data set containing firm failure and credit ratings information from the rating agencies S&P and Moody's for US listed companies.

AI Key Findings

Generated Sep 05, 2025

Methodology

A multivariate ordinal regression model with a multivariate autoregressive structure is proposed to account for dependence between repeated and multiple ordinal measurements.

Key Results

- The proposed model performs well in terms of CLAIC and CLBIC, outperforming simpler specifications that only consider cross-sectional correlations or time-dependent effects.

- The simulation study confirms the recovery of model parameters and shows that the pair-wise likelihood approach is competitive with a Bayesian approach in terms of computation time and accuracy.

- The proposed model improves the fit compared to simpler specifications, indicating its potential for enhancing credit risk modeling.

Significance

This research contributes to the development of multivariate ordinal regression models for panel data, which can improve the accuracy of credit risk assessment and other applications where multiple ordinal measurements are involved.

Technical Contribution

The proposed model provides a novel approach to accounting for dependence between multiple ordinal measurements, which is essential for accurate credit risk assessment and other applications involving panel data.

Novelty

This work contributes to the development of multivariate ordinal regression models with autoregressive structures, offering a new perspective on handling dependence in multiple ordinal measurements.

Limitations

- The pair-wise likelihood estimation approach may lead to over-optimistic standard errors for threshold parameters.

- Further research is needed to investigate approaches that can model missing data mechanisms jointly with observations, which is often the case in longitudinal studies.

Future Work

- Developing methods to address the issue of over-optimistic standard errors for threshold parameters through resampling techniques such as jackknife or bootstrap.

- Investigating approaches that can model missing data mechanisms jointly with observations in multivariate ordinal regression models.

Paper Details

PDF Preview

Key Terms

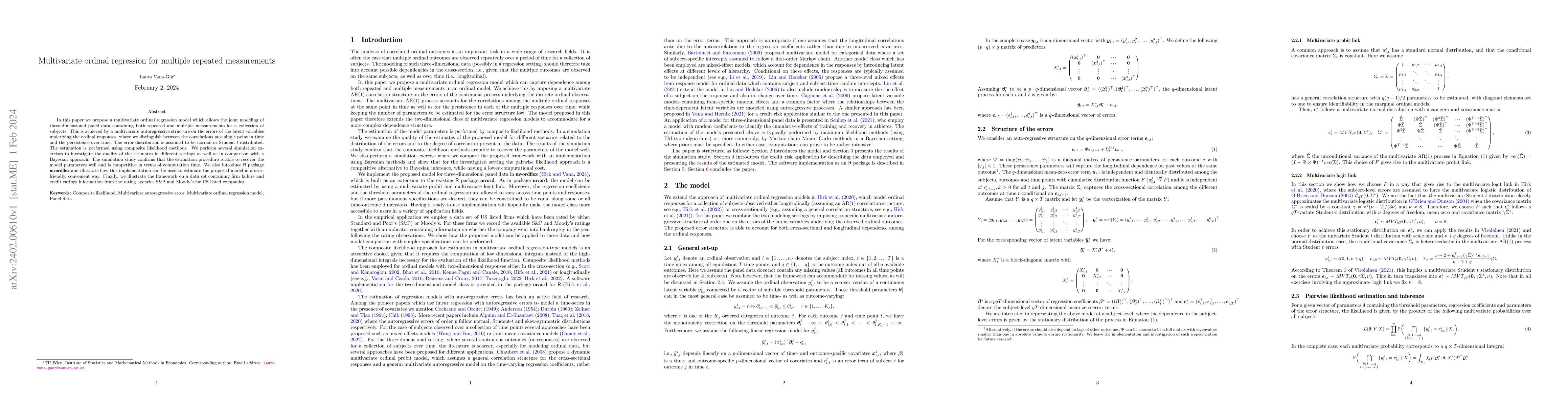

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)