Summary

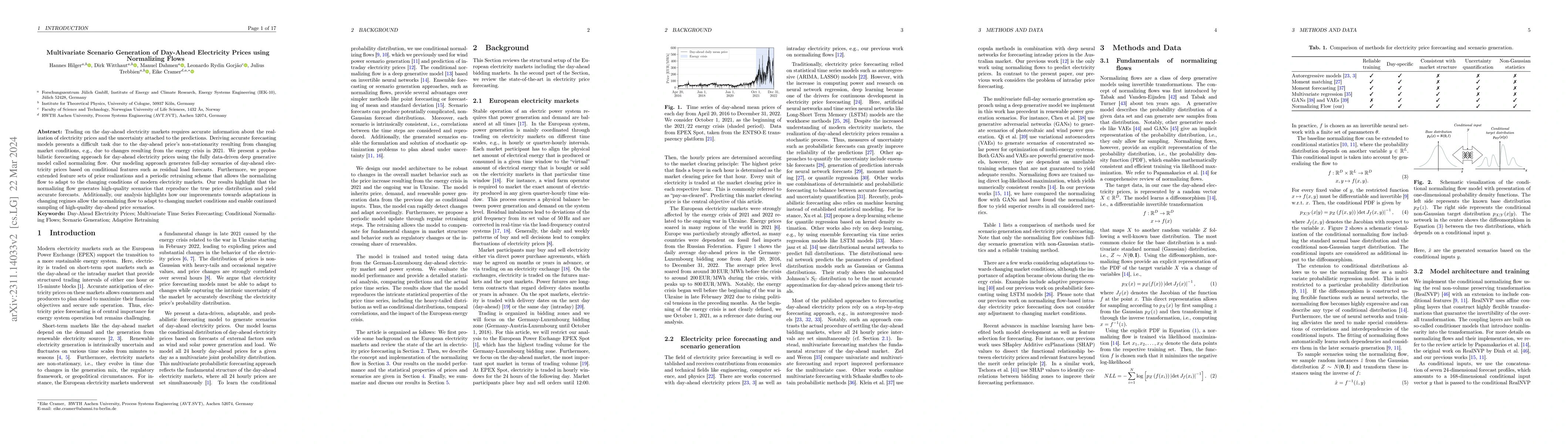

Trading on the day-ahead electricity markets requires accurate information about the realization of electricity prices and the uncertainty attached to the predictions. Deriving accurate forecasting models presents a difficult task due to the day-ahead price's non-stationarity resulting from changing market conditions, e.g., due to changes resulting from the energy crisis in 2021. We present a probabilistic forecasting approach for day-ahead electricity prices using the fully data-driven deep generative model called normalizing flow. Our modeling approach generates full-day scenarios of day-ahead electricity prices based on conditional features such as residual load forecasts. Furthermore, we propose extended feature sets of prior realizations and a periodic retraining scheme that allows the normalizing flow to adapt to the changing conditions of modern electricity markets. Our results highlight that the normalizing flow generates high-quality scenarios that reproduce the true price distribution and yield accurate forecasts. Additionally, our analysis highlights how our improvements towards adaptations in changing regimes allow the normalizing flow to adapt to changing market conditions and enable continued sampling of high-quality day-ahead price scenarios.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMultivariate Probabilistic Forecasting of Intraday Electricity Prices using Normalizing Flows

Alexander Mitsos, Dirk Witthaut, Manuel Dahmen et al.

Learning Probability Distributions of Day-Ahead Electricity Prices

Jozef Barunik, Lubos Hanus

Multivariate Probabilistic CRPS Learning with an Application to Day-Ahead Electricity Prices

Jonathan Berrisch, Florian Ziel

Normalizing Flow-based Day-Ahead Wind Power Scenario Generation for Profitable and Reliable Delivery Commitments by Wind Farm Operators

Alexander Mitsos, Manuel Dahmen, Eike Cramer et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)