Authors

Summary

We establish a comprehensive sample path large deviation principle (LDP) for log-processes associated with multivariate time-inhomogeneous stochastic volatility models. Examples of models for which the new LDP holds include Gaussian models, non-Gaussian fractional models, mixed models, models with reflection, and models in which the volatility process is a solution to a Volterra type stochastic integral equation. The LDP for log-processes is used to obtain large deviation style asymptotic formulas for the distribution function of the first exit time of a log-process from an open set and for the price of a multidimensional binary barrier option. We also prove a sample path LDP for solutions to Volterra type stochastic integral equations with predictable coefficients depending on auxiliary stochastic processes.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

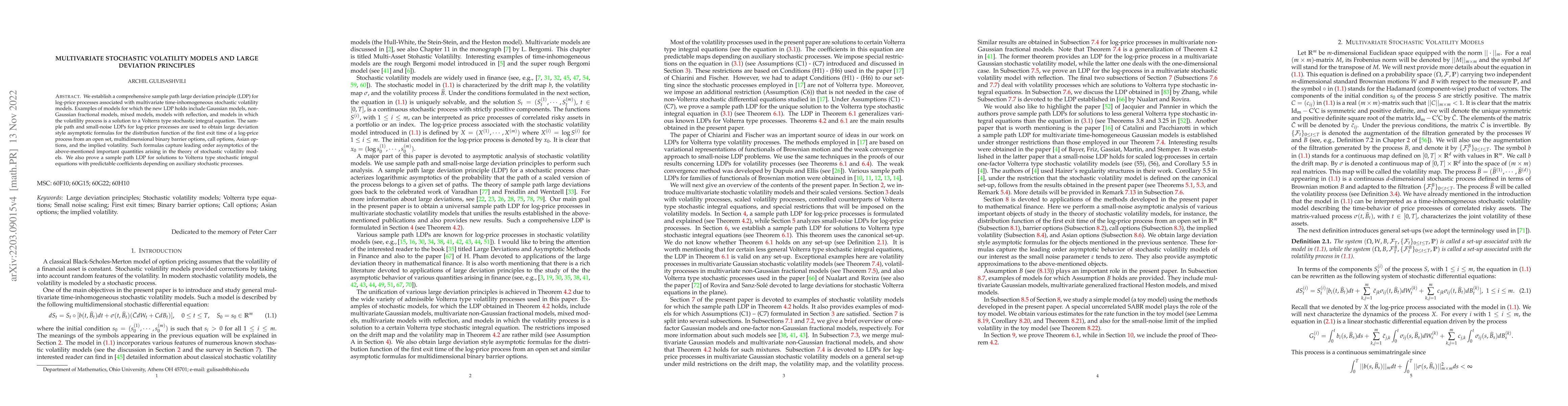

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)