Summary

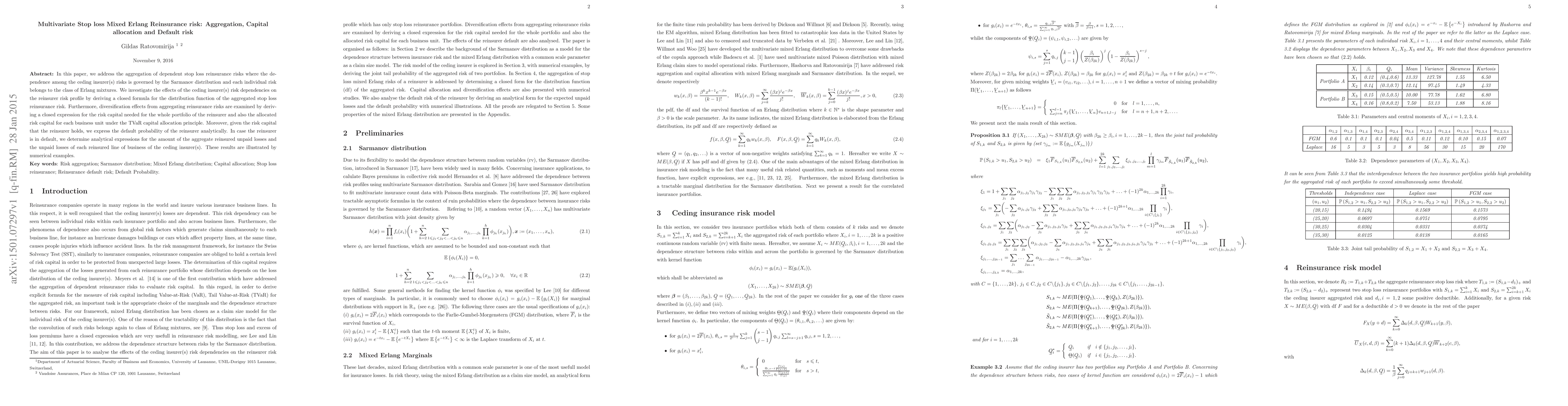

In this paper, we address the aggregation of dependent stop loss reinsurance risks where the dependence among the ceding insurer(s) risks is governed by the Sarmanov distribution and each individual risk belongs to the class of Erlang mixtures. We investigate the effects of the ceding insurer(s) risk dependencies on the reinsurer risk profile by deriving a closed formula for the distribution function of the aggregated stop loss reinsurance risk. Furthermore, diversification effects from aggregating reinsurance risks are examined by deriving a closed expression for the risk capital needed for the whole portfolio of the reinsurer and also the allocated risk capital for each business unit under the TVaR capital allocation principle. Moreover, given the risk capital that the reinsurer holds, we express the default probability of the reinsurer analytically. In case the reinsurer is in default, we determine analytical expressions for the amount of the aggregate reinsured unpaid losses and the unpaid losses of each reinsured line of business of the ceding insurer(s). These results are illustrated by numerical examples.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)