Summary

We show that the mutual fund theorems of Merton (1971) extend to the problem of optimal investment to minimize the probability of lifetime ruin. We obtain two such theorems by considering a financial market both with and without a riskless asset for random consumption. The striking result is that we obtain two-fund theorems despite the additional source of randomness from consumption.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

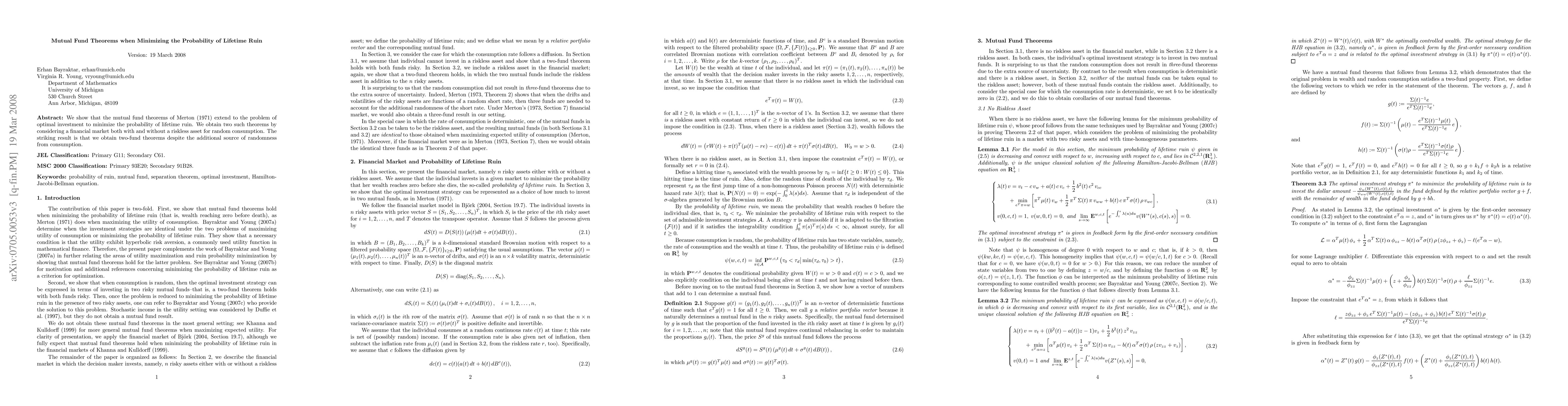

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)