Summary

In the last years efforts in econophysics have been shifted to study how network theory can facilitate understanding of complex financial markets. Main part of these efforts is the study of correlation-based hierarchical networks. This is somewhat surprising as the underlying assumptions of research looking at financial markets is that they behave chaotically. In fact it's common for econophysicists to estimate maximal Lyapunov exponent for log returns of a given financial asset to confirm that prices behave chaotically. Chaotic behaviour is only displayed by dynamical systems which are either non-linear or infinite-dimensional. Therefore it seems that non-linearity is an important part of financial markets, which is proved by numerous studies confirming financial markets display significant non-linear behaviour, yet network theory is used to study them using almost exclusively correlations and partial correlations, which are inherently dealing with linear dependencies only. In this paper we introduce a way to incorporate non-linear dynamics and dependencies into hierarchical networks to study financial markets using mutual information and its dynamical extension: the mutual information rate. We estimate it using multidimensional Lempel-Ziv complexity and then convert it into an Euclidean metric in order to find appropriate topological structure of networks modelling financial markets. We show that this approach leads to different results than correlation-based approach used in most studies, on the basis of 15 biggest companies listed on Warsaw Stock Exchange in the period of 2009-2012 and 91 companies listed on NYSE100 between 2003 and 2013, using minimal spanning trees and planar maximally filtered graphs.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

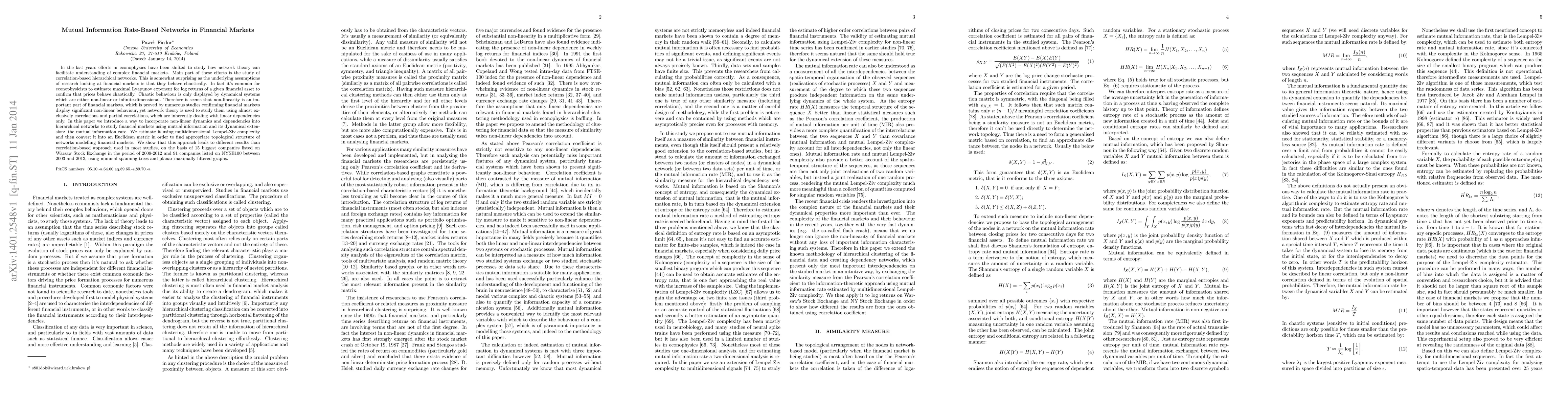

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)