Authors

Summary

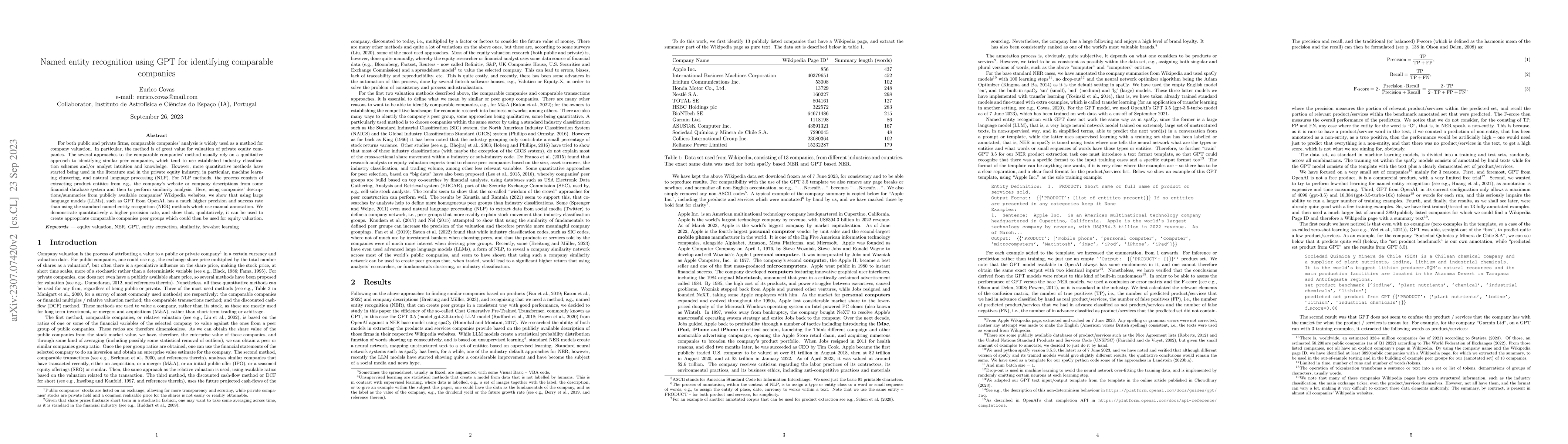

For both public and private firms, comparable companies' analysis is widely used as a method for company valuation. In particular, the method is of great value for valuation of private equity companies. The several approaches to the comparable companies' method usually rely on a qualitative approach to identifying similar peer companies, which tend to use established industry classification schemes and/or analyst intuition and knowledge. However, more quantitative methods have started being used in the literature and in the private equity industry, in particular, machine learning clustering, and natural language processing (NLP). For NLP methods, the process consists of extracting product entities from e.g., the company's website or company descriptions from some financial database system and then to perform similarity analysis. Here, using companies' descriptions/summaries from publicly available companies' Wikipedia websites, we show that using large language models (LLMs), such as GPT from OpenAI, has a much higher precision and success rate than using the standard named entity recognition (NER) methods which use manual annotation. We demonstrate quantitatively a higher precision rate, and show that, qualitatively, it can be used to create appropriate comparable companies peer groups which could then be used for equity valuation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersGPT-NER: Named Entity Recognition via Large Language Models

Fei Wu, Tianwei Zhang, Guoyin Wang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)