Summary

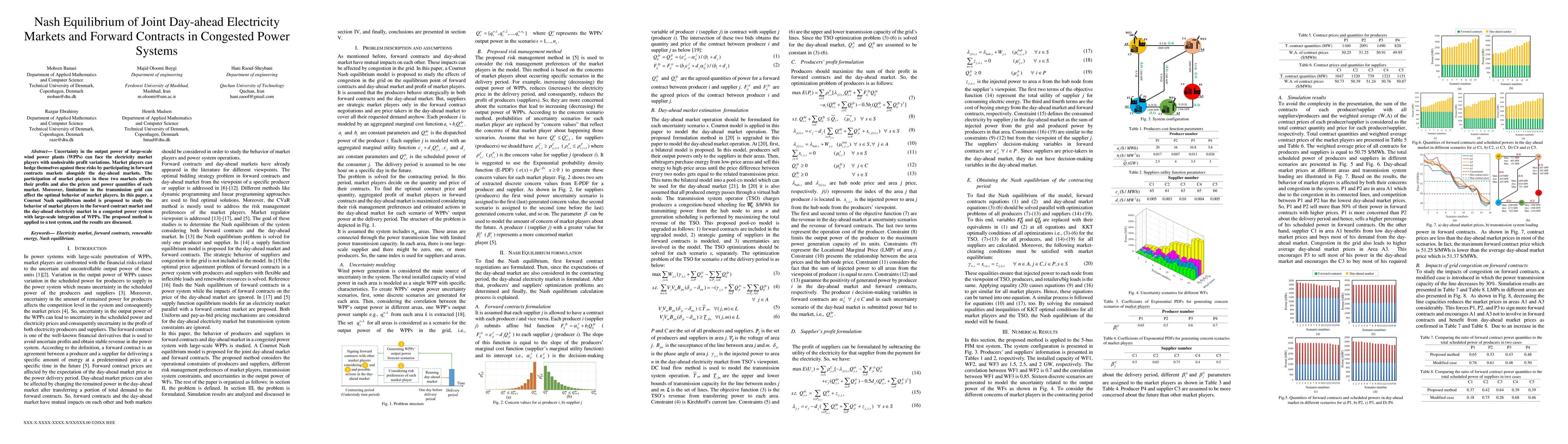

Uncertainty in the output power of large-scale wind power plants (WPPs) can face the electricity market players with undesirable profit variations. Market players can hedge themselves against these risks by participating in forward contracts markets alongside the day-ahead markets. The participation of market players in these two markets affects their profits and also the prices and power quantities of each market. Moreover, limitations in the transmission grid can affect the optimal behavior of market players. In this paper, a Cournot Nash equilibrium model is proposed to study the behavior of market players in the forward contract market and the day-ahead electricity market in a congested power system with large-scale integration of WPPs. The proposed method is applied to a test system, and the results are discussed.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)