Summary

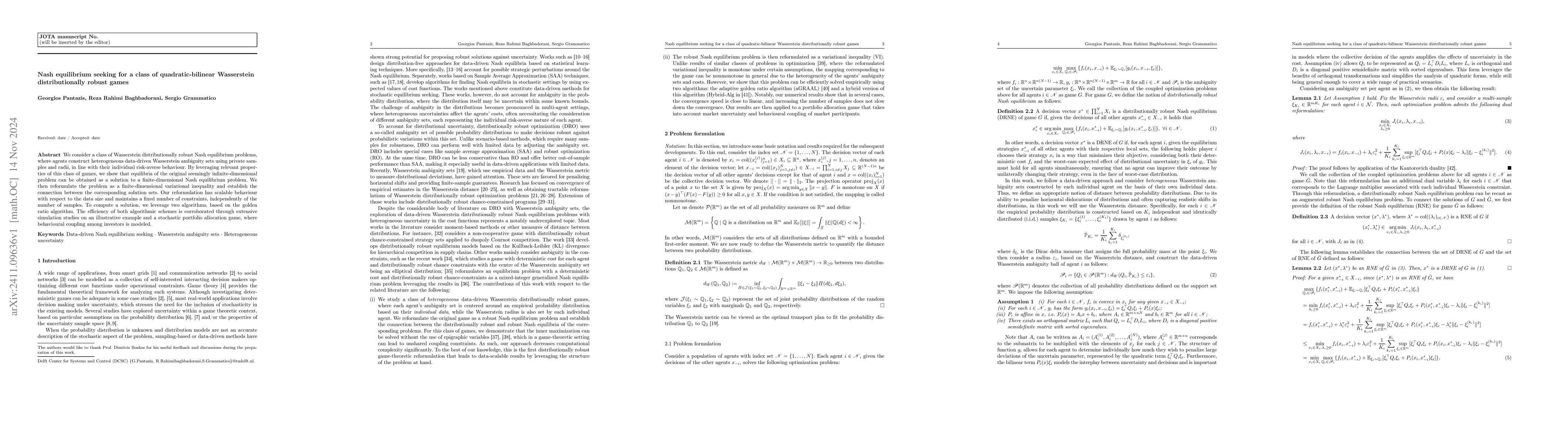

We consider a class of Wasserstein distributionally robust Nash equilibrium problems, where agents construct heterogeneous data-driven Wasserstein ambiguity sets using private samples and radii, in line with their individual risk-averse behaviour. By leveraging relevant properties of this class of games, we show that equilibria of the original seemingly infinite-dimensional problem can be obtained as a solution to a finite-dimensional Nash equilibrium problem. We then reformulate the problem as a finite-dimensional variational inequality and establish the connection between the corresponding solution sets. Our reformulation has scalable behaviour with respect to the data size and maintains a fixed number of constraints, independently of the number of samples. To compute a solution, we leverage two algorithms, based on the golden ratio algorithm. The efficiency of both algorithmic schemes is corroborated through extensive simulation studies on an illustrative example and a stochastic portfolio allocation game, where behavioural coupling among investors is modeled.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersOn data-driven Wasserstein distributionally robust Nash equilibrium problems with heterogeneous uncertainty

Sergio Grammatico, Barbara Franci, George Pantazis

Sliding-Mode Nash Equilibrium Seeking for a Quadratic Duopoly Game

Miroslav Krstić, Tamer Başar, Tiago Roux Oliveira et al.

Fast Distributed Nash Equilibrium Seeking in Monotone Games

Angelia Nedich, Tatiana Tatarenko

Distributed Event-Triggered Nash Equilibrium Seeking for Noncooperative Games

Miroslav Krstic, Tiago Roux Oliveira, Victor Hugo Pereira Rodrigues et al.

No citations found for this paper.

Comments (0)