Summary

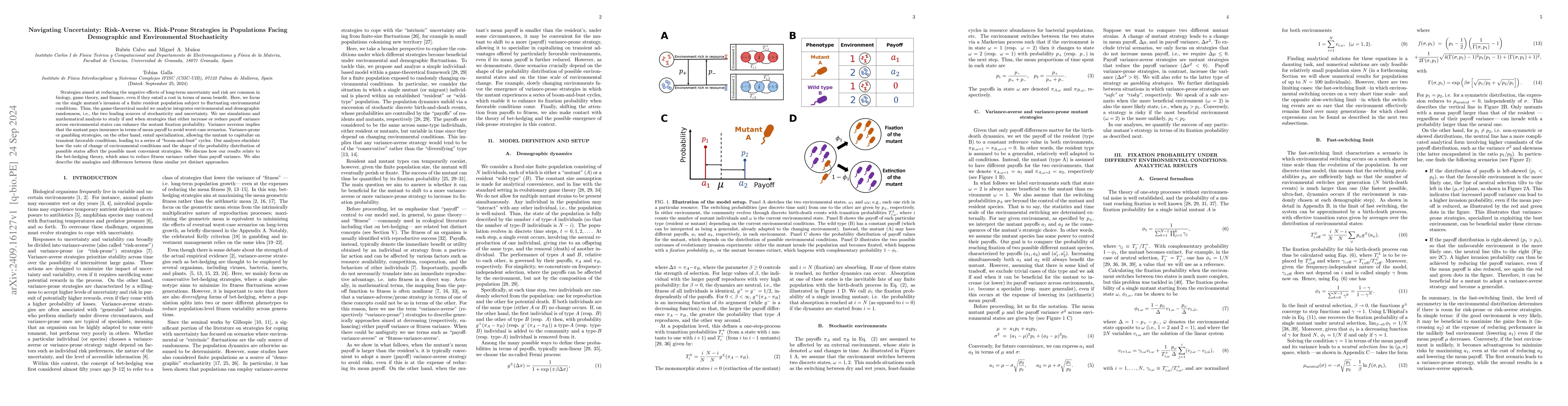

Strategies aimed at reducing the negative effects of long-term uncertainty and risk are common in biology, game theory, and finance, even if they entail a cost in terms of mean benefit. Here, we focus on the single mutant's invasion of a finite resident population subject to fluctuating environmental conditions. Thus, the game-theoretical model we analyze integrates environmental and demographic randomness, i.e., the two leading sources of stochasticity and uncertainty. We use simulations and mathematical analysis to study if and when strategies that either increase or reduce payoff variance across environmental states can enhance the mutant fixation probability. Variance aversion implies that the mutant pays insurance in terms of mean payoff to avoid worst-case scenarios. Variance-prone or gambling strategies, on the other hand, entail specialization, allowing the mutant to capitalize on transient favorable conditions, leading to a series of ``boom-and-bust'' cycles. Our analyses elucidate how the rate of change of environmental conditions and the shape of the probability distribution of possible states affect the possible most convenient strategies. We discuss how our results relate to the bet-hedging theory, which aims to reduce fitness variance rather than payoff variance. We also describe the analogies and differences between these similar yet distinct approaches.

AI Key Findings

Generated Sep 02, 2025

Methodology

The research employs a game-theoretical model integrating environmental and demographic randomness to study the invasion of a single mutant into a finite resident population under fluctuating conditions. It uses simulations and mathematical analysis to explore how variance aversion or variance-prone strategies affect mutant fixation probability.

Key Results

- Variance aversion strategies (insurance against worst-case scenarios) can enhance mutant fixation probability when environmental conditions change rapidly.

- Variance-prone or gambling strategies, which specialize in capitalizing on transient favorable conditions, lead to 'boom-and-bust' cycles and can also increase mutant fixation probability under slow environmental changes.

- The rate of environmental change and the shape of the probability distribution of possible states significantly influence the most convenient strategies for mutants.

- The results elucidate the relationship between bet-hedging theory and these approaches, highlighting similarities and differences.

- Analytical insights for infinitely large populations reveal that, in addition to environmental state probabilities, the actual timescale of environmental dynamics plays a crucial role in determining the fate of mutants.

Significance

This research contributes to understanding how populations navigate uncertainty by adopting risk-averse or risk-prone strategies in the face of demographic and environmental stochasticity, with implications for biology, game theory, and finance.

Technical Contribution

The paper presents a comprehensive mathematical and simulation-based analysis of how variance aversion and variance-prone strategies influence mutant fixation probability in populations subject to fluctuating environmental conditions.

Novelty

The work combines game theory, stochastic processes, and population dynamics to provide a novel perspective on risk-averse versus risk-prone strategies in biological populations, extending previous research by explicitly considering both demographic and environmental stochasticity.

Limitations

- The study focuses on a single mutant's invasion and may not fully capture the complexity of multi-mutant scenarios.

- The model assumes specific payoff distributions and switching rates, which might not universally apply to all real-world situations.

Future Work

- Investigate the impact of multiple mutants and their interactions on population dynamics under stochastic environments.

- Explore the applicability of the findings across diverse biological systems and ecological contexts.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)