Summary

In this paper, we consider a discrete-time portfolio with $m \geq 2$ assets optimization problem which includes the rebalancing~frequency as an additional parameter in the maximization. The so-called Kelly Criterion is used as the performance metric; i.e., maximizing the expected logarithmic growth of a trader's account, and the portfolio obtained is called the frequency-based Kelly optimal portfolio. The focal point of this paper is to extend upon the results of our previous work to obtain various optimality characterizations on the portfolio. To be more specific, using Kelly's criterion in our frequency-based formulation, we first prove necessary and sufficient conditions for the frequency-based Kelly optimal portfolio. With the aid of these conditions, we then show several new optimality characterizations such as expected ratio optimality and asymptotic relative optimality, and a result which we call the Extended Dominant Asset Theorem. That is, we prove that the $i$th asset is dominant in the portfolio if and only if the Kelly optimal portfolio consists of that asset only. The word "extended" on the theorem comes from the fact that it was only a sufficiency result that was proved in our previous work. Hence, in this paper, we improve it to involve a proof of the necessity part. In addition, the trader's survivability issue (no bankruptcy consideration) is also studied in detail in our frequency-based trading framework. Finally, to bridge the theory and practice, we propose a simple trading algorithm using the notion called dominant asset condition to decide when should one triggers a trade. The corresponding trading performance using historical price data is reported as supporting evidence.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

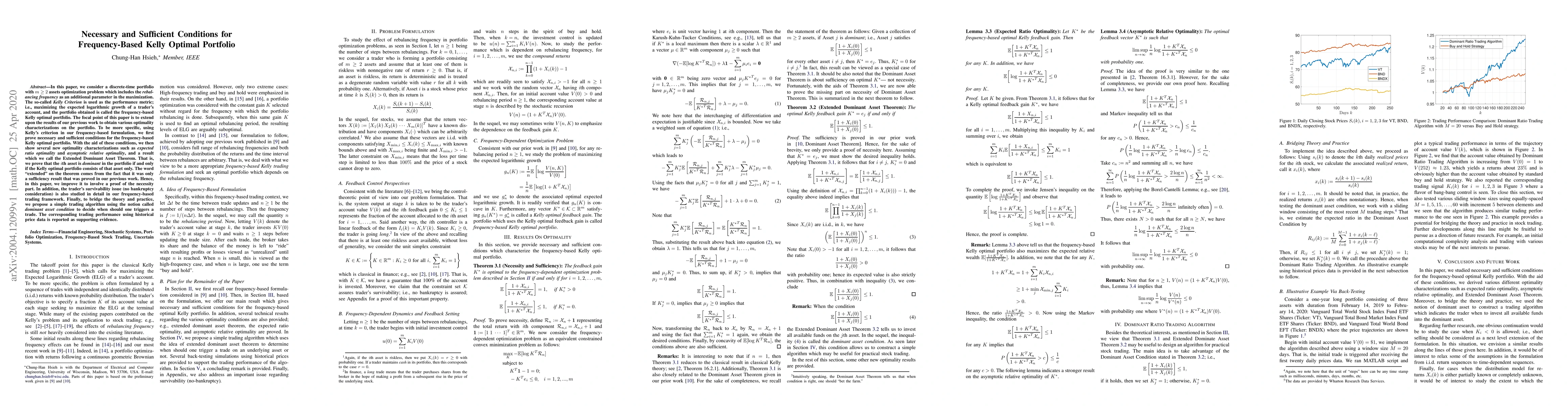

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)