Summary

We show that the existence of an equivalent local martingale measure for asset prices does not prevent negative prices for European calls written on positive stock prices. In particular, we illustrate that many standard no-arbitrage arguments implicitly rely on conditions stronger than the No Free Lunch With Vanishing Risk (NFLVR) assumption. The discrepancy between replicating prices and market prices for a contingent claim may be observed in a model satisfying NFLVR since certain trading strategies of buying one portfolio and selling another one are often excluded by standard admissibility constraints.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

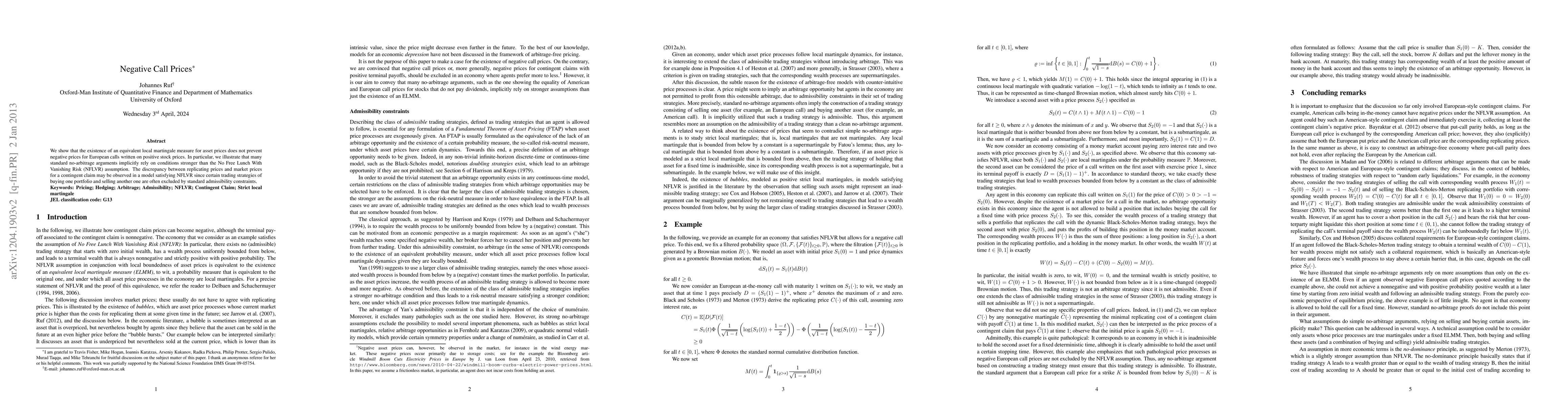

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)