Summary

The combination of the network theoretic approach with recently available abundant economic data leads to the development of novel analytic and computational tools for modelling and forecasting key economic indicators. The main idea is to introduce a topological component into the analysis, taking into account consistently all higher-order interactions. We present three basic methodologies to demonstrate different approaches to harness the resulting network gain. First, a multiple linear regression optimisation algorithm is used to generate a relational network between individual components of national balance of payment accounts. This model describes annual statistics with a high accuracy and delivers good forecasts for the majority of indicators. Second, an early-warning mechanism for global financial crises is presented, which combines network measures with standard economic indicators. From the analysis of the cross-border portfolio investment network of long-term debt securities, the proliferation of a wide range of over-the-counter-traded financial derivative products, such as credit default swaps, can be described in terms of gross-market values and notional outstanding amounts, which are associated with increased levels of market interdependence and systemic risk. Third, considering the flow-network of goods traded between G-20 economies, network statistics provide better proxies for key economic measures than conventional indicators. For example, it is shown that a country's gate-keeping potential, as a measure for local power, projects its annual change of GDP generally far better than the volume of its imports or exports.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

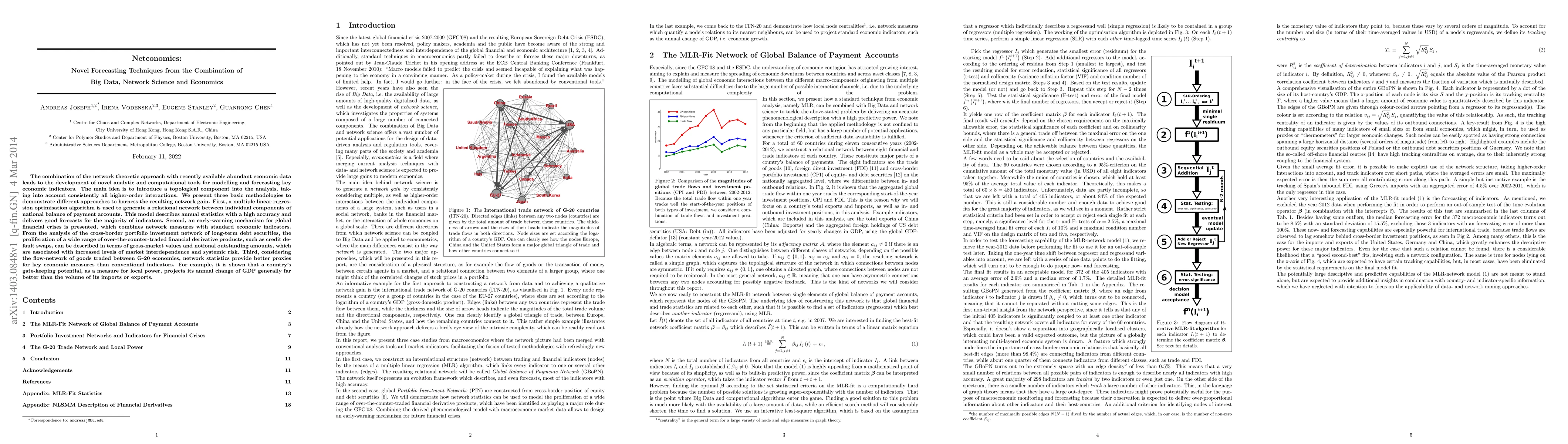

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

No similar papers found for this research.

| Title | Authors | Year | Actions |

|---|

Comments (0)