Authors

Summary

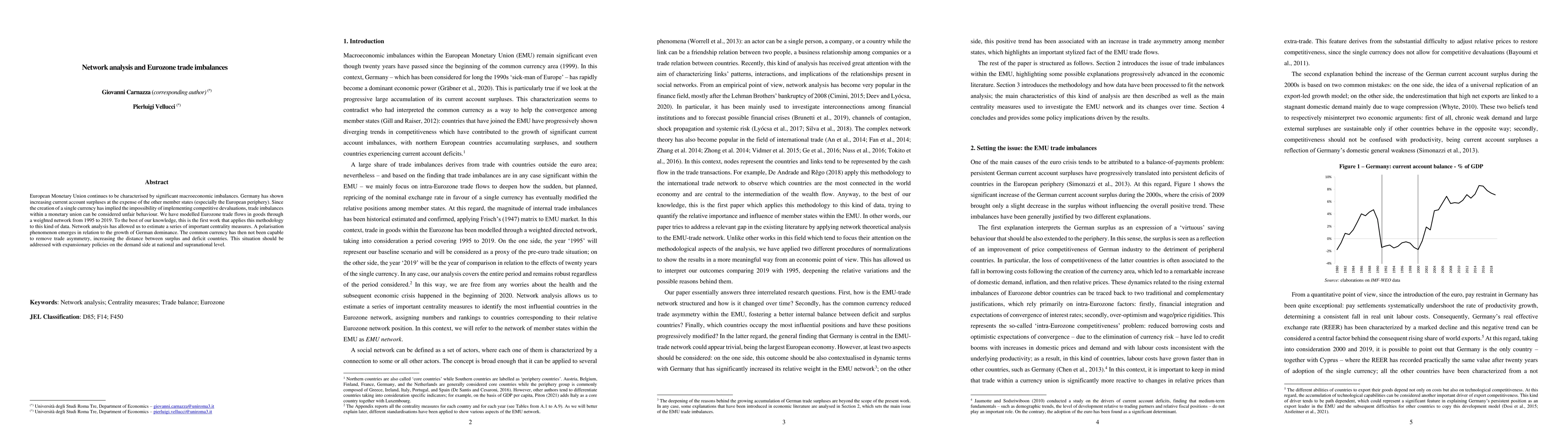

European Monetary Union continues to be characterised by significant macroeconomic imbalances. Germany has shown increasing current account surpluses at the expense of the other member states (especially the European periphery). Since the creation of a single currency has implied the impossibility of implementing competitive devaluations, trade imbalances within a monetary union can be considered unfair behaviour. We have modelled Eurozone trade flows in goods through a weighted network from 1995 to 2019. To the best of our knowledge, this is the first work that applies this methodology to this kind of data. Network analysis has allowed us to estimate a series of important centrality measures. A polarisation phenomenon emerges in relation to the growth of German dominance. The common currency has then not been capable to remove trade asymmetry, increasing the distance between surplus and deficit countries. This situation should be addressed with expansionary policies on the demand side at national and supranational level.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersInternational Trade Network: Statistical Analysis and Modeling

Juan Sosa, Andrés Felipe Arévalo-Arévalo, Juan Pablo Torres-Clavijo

No citations found for this paper.

Comments (0)