Authors

Summary

A new algorithm of the analysis of correlation among economy time series is proposed. The algorithm is based on the power law classification scheme (PLCS) followed by the analysis of the network on the percolation threshold (NPT). The algorithm was applied to the analysis of correlations among GDP per capita time series of 19 most developed countries in the periods (1982, 2011), (1992, 2011) and (2002, 2011). The representative countries with respect to strength of correlation, convergence of time series and stability of correlation are distinguished. The results are compared with ultrametric distance matrix analysed by NPT.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

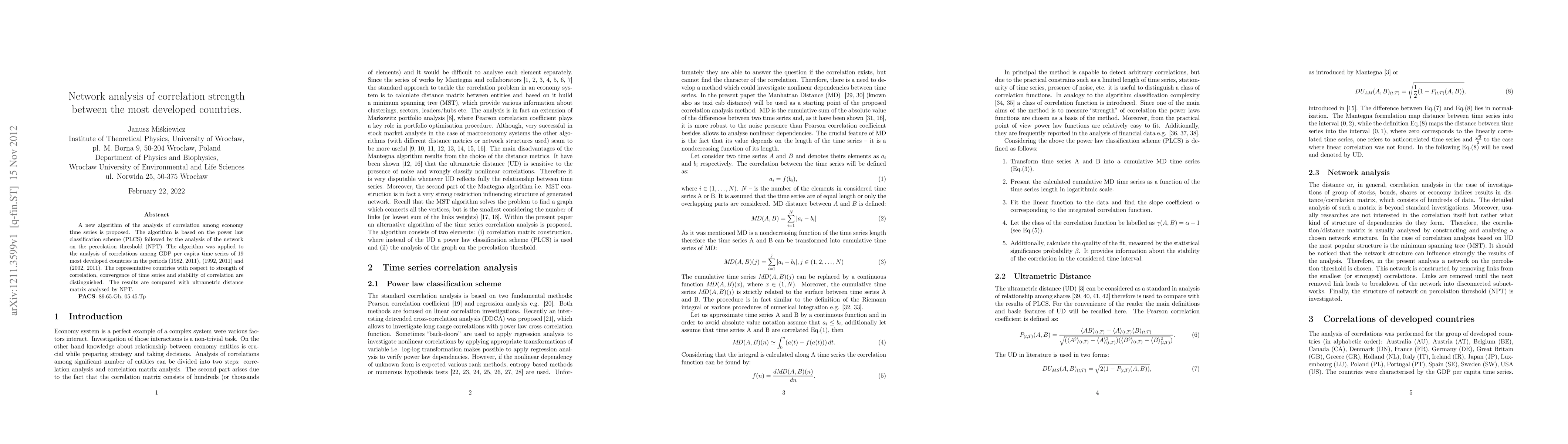

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)