Summary

A growing body of studies on systemic risk in financial markets has emphasized the key importance of taking into consideration the complex interconnections among financial institutions. Much effort has been put in modeling the contagion dynamics of financial shocks, and to assess the resilience of specific financial markets - either using real network data, reconstruction techniques or simple toy networks. Here we address the more general problem of how shock propagation dynamics depends on the topological details of the underlying network. To this end we consider different realistic network topologies, all consistent with balance sheets information obtained from real data on financial institutions. In particular, we consider networks of varying density and with different block structures, and diversify as well in the details of the shock propagation dynamics. We confirm that the systemic risk properties of a financial network are extremely sensitive to its network features. Our results can aid in the design of regulatory policies to improve the robustness of financial markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

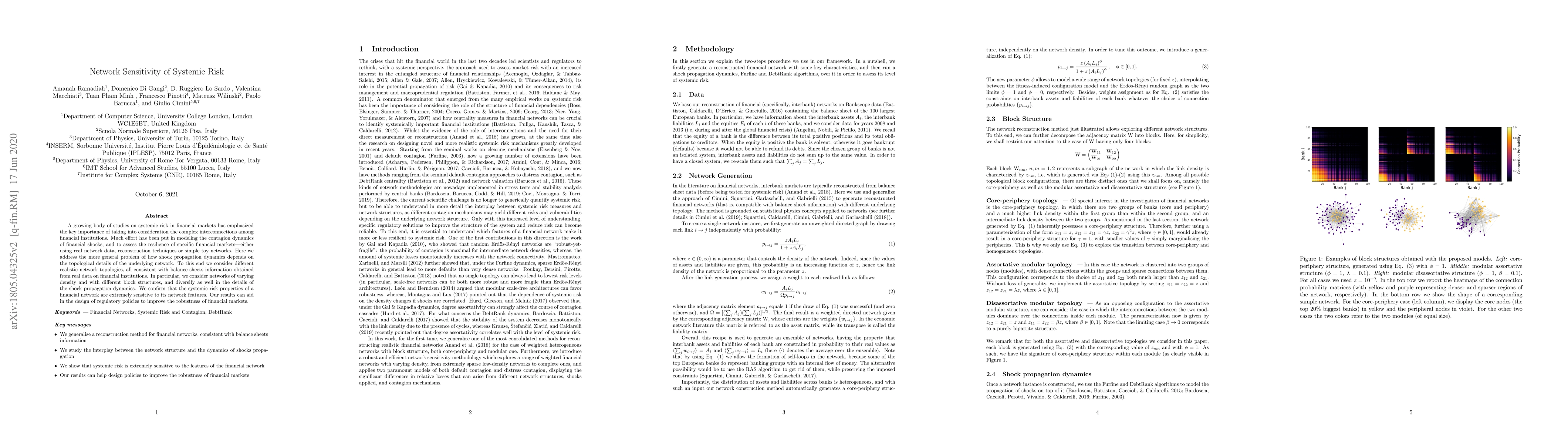

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSystemic risk mitigation in supply chains through network rewiring

Stefan Thurner, Leonardo Niccolò Ialongo, Giacomo Zelbi

Systemic risk in interbank networks: disentangling balance sheets and network effects

Giulio Cimini, Alessandro Ferracci

| Title | Authors | Year | Actions |

|---|

Comments (0)