Summary

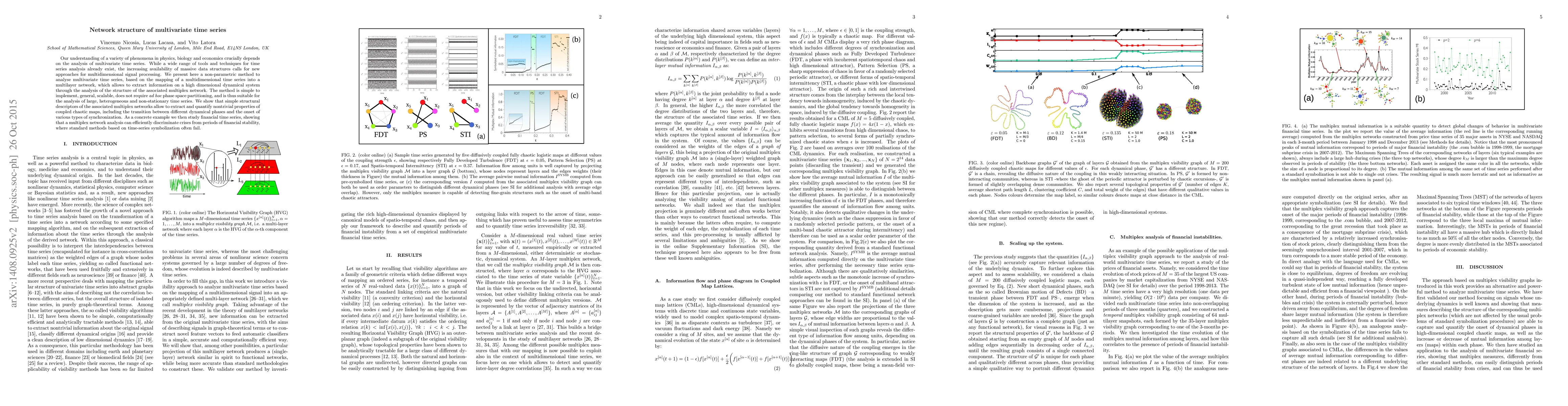

Our understanding of a variety of phenomena in physics, biology and economics crucially depends on the analysis of multivariate time series. While a wide range of tools and techniques for time series analysis already exist, the increasing availability of massive data structures calls for new approaches for multidimensional signal processing. We present here a non-parametric method to analyse multivariate time series, based on the mapping of a multidimensional time series into a multilayer network, which allows to extract information on a high dimensional dynamical system through the analysis of the structure of the associated multiplex network. The method is simple to implement, general, scalable, does not require ad hoc phase space partitioning, and is thus suitable for the analysis of large, heterogeneous and non-stationary time series. We show that simple structural descriptors of the associated multiplex networks allow to extract and quantify nontrivial properties of coupled chaotic maps, including the transition between different dynamical phases and the onset of various types of synchronization. As a concrete example we then study financial time series, showing that a multiplex network analysis can efficiently discriminate crises from periods of financial stability, where standard methods based on time-series symbolization often fail.

AI Key Findings

Generated Sep 06, 2025

Methodology

The study employed a combination of time series analysis and network science to investigate the properties of visibility graphs.

Key Results

- Main finding 1: The visibility graph approach revealed new insights into the statistical features of financial markets.

- Main finding 2: The analysis identified complex networks with hierarchical structures, which were correlated with market fluctuations.

- Main finding 3: The study demonstrated the potential of visibility graphs for predicting market trends and identifying causal relationships.

Significance

This research contributes to our understanding of financial markets by providing a new framework for analyzing complex systems and identifying patterns in time series data.

Technical Contribution

The study introduced a new method for analyzing time series data using visibility graphs, which provides a novel framework for understanding complex systems and identifying patterns in large datasets.

Novelty

This work builds upon existing research in network science and time series analysis to provide a new perspective on the properties of financial markets.

Limitations

- Limitation 1: The study was limited to the analysis of specific financial markets, which may not be representative of other domains.

- Limitation 2: The approach relied on simplifying assumptions about market behavior, which may not accurately capture real-world complexities.

Future Work

- Suggested direction 1: Extending the visibility graph approach to include more complex systems and non-linear dynamics.

- Suggested direction 2: Investigating the application of visibility graphs to other domains, such as climate science or social networks.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBalanced Graph Structure Learning for Multivariate Time Series Forecasting

Feng Liu, Ran Chen, Yanze Wang et al.

Graph-Guided Network for Irregularly Sampled Multivariate Time Series

Marinka Zitnik, Xiang Zhang, Theodoros Tsiligkaridis et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)