Summary

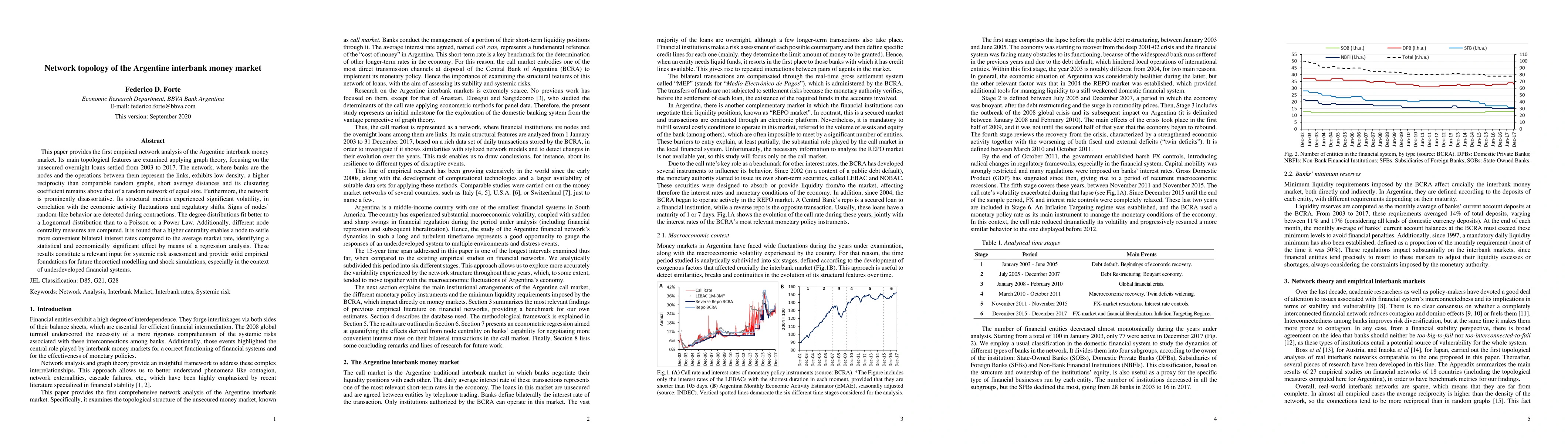

This paper provides the first empirical network analysis of the Argentine interbank money market. Its main topological features are examined applying graph theory, focusing on the unsecured overnight loans settled from 2003 to 2017. The network, where banks are the nodes and the operations between them represent the links, exhibits low density, a higher reciprocity than comparable random graphs, short average distances and its clustering coefficient remains above that of a random network of equal size. Furthermore, the network is prominently disassortative. Its structural metrics experienced significant volatility, in correlation with the economic activity fluctuations and regulatory shifts. Signs of nodes' random-like behavior are detected during contractions. The degree distributions fit better to a Lognormal distribution than to a Poisson or a Power Law. Additionally, different node centrality measures are computed. It is found that a higher centrality enables a node to settle more convenient bilateral interest rates compared to the average market rate, identifying a statistical and economically significant effect by means of a regression analysis. These results constitute a relevant input for systemic risk assessment and provide solid empirical foundations for future theoretical modelling and shock simulations, especially in the context of underdeveloped financial systems.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)