Authors

Summary

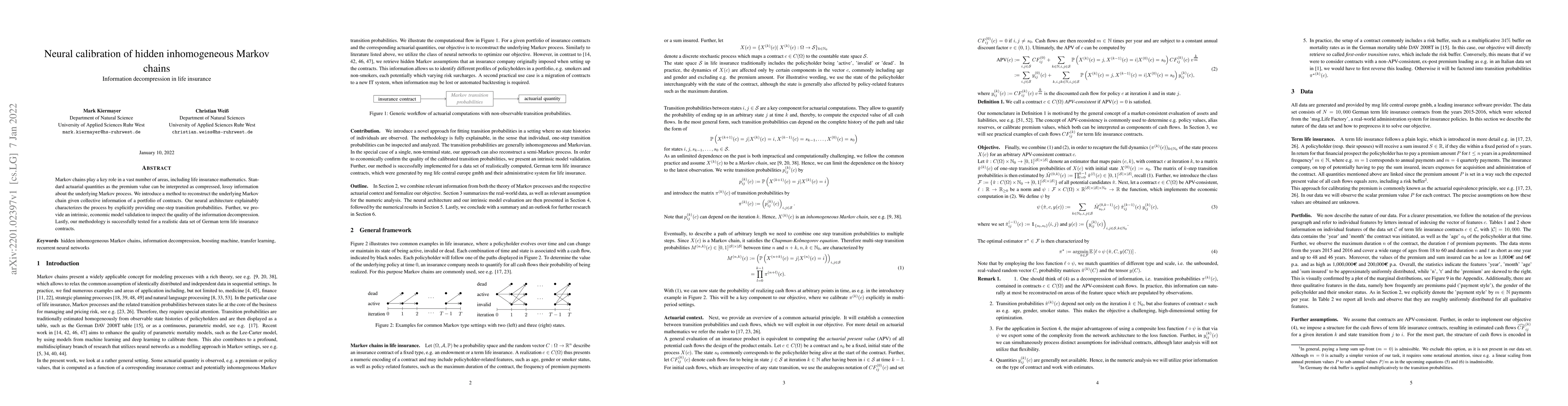

Markov chains play a key role in a vast number of areas, including life insurance mathematics. Standard actuarial quantities as the premium value can be interpreted as compressed, lossy information about the underlying Markov process. We introduce a method to reconstruct the underlying Markov chain given collective information of a portfolio of contracts. Our neural architecture explainably characterizes the process by explicitly providing one-step transition probabilities. Further, we provide an intrinsic, economic model validation to inspect the quality of the information decompression. Lastly, our methodology is successfully tested for a realistic data set of German term life insurance contracts.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAggregate Markov models in life insurance: estimation via the EM algorithm

Jamaal Ahmad, Mogens Bladt

Aggregate Markov models in life insurance: properties and valuation

Christian Furrer, Jamaal Ahmad, Mogens Bladt

No citations found for this paper.

Comments (0)