Authors

Summary

We introduce a novel neural-network-based approach to learning the generating function $G(\cdot)$ of a functionally generated portfolio (FGP) from synthetic or real market data. In the neural network setting, the generating function is represented as $G_{\theta}(\cdot)$, where $\theta$ is an iterable neural network parameter vector, and $G_{\theta}(\cdot)$ is trained to maximise investment return relative to the market portfolio. We compare the performance of the Neural FGP approach against classical FGP benchmarks. FGPs provide a robust alternative to classical portfolio optimisation by bypassing the need to estimate drifts or covariances. The neural FGP framework extends this by introducing flexibility in the design of the generating function, enabling it to learn from market dynamics while preserving self-financing and pathwise decomposition properties.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

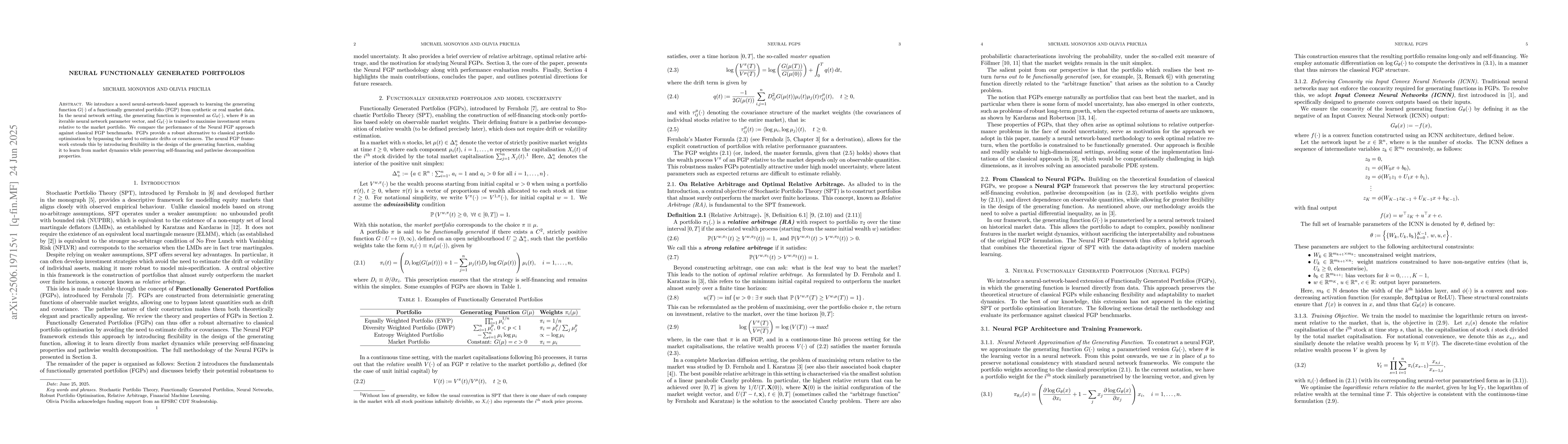

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFunctionally Generated Portfolios Under Stochastic Transaction Costs: Theory and Empirical Evidence

Nader Karimi, Erfan Salavati

No citations found for this paper.

Comments (0)