Authors

Summary

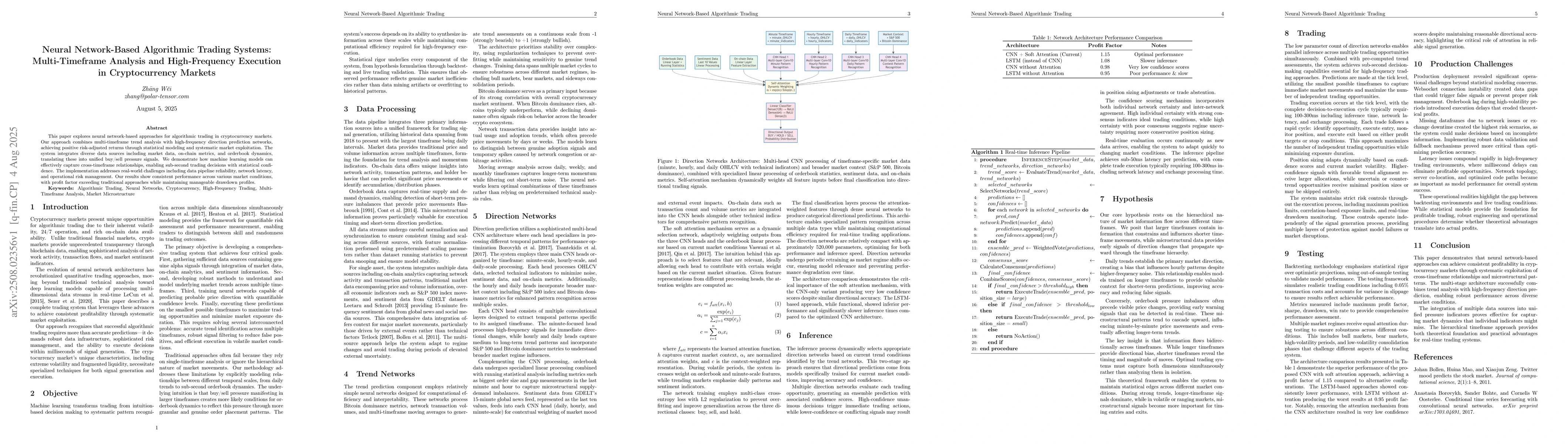

This paper explores neural network-based approaches for algorithmic trading in cryptocurrency markets. Our approach combines multi-timeframe trend analysis with high-frequency direction prediction networks, achieving positive risk-adjusted returns through statistical modeling and systematic market exploitation. The system integrates diverse data sources including market data, on-chain metrics, and orderbook dynamics, translating these into unified buy/sell pressure signals. We demonstrate how machine learning models can effectively capture cross-timeframe relationships, enabling sub-second trading decisions with statistical confidence.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersPulseReddit: A Novel Reddit Dataset for Benchmarking MAS in High-Frequency Cryptocurrency Trading

Qian Wang, Atsushi Yoshikawa, Qiuhan Han et al.

Pairwise and high-order dependencies in the cryptocurrency trading network

Alessandro Pluchino, Andrea Rapisarda, Sebastiano Stramaglia et al.

Probabilistic Multi-product Trading in Sequential Intraday and Frequency-Regulation Markets

Mohammad Reza Hesamzadeh, Saeed Nordin, Abolfazl Khodadadi et al.

Neural Hawkes: Non-Parametric Estimation in High Dimension and Causality Analysis in Cryptocurrency Markets

Timothée Fabre, Ioane Muni Toke

Comments (0)