Summary

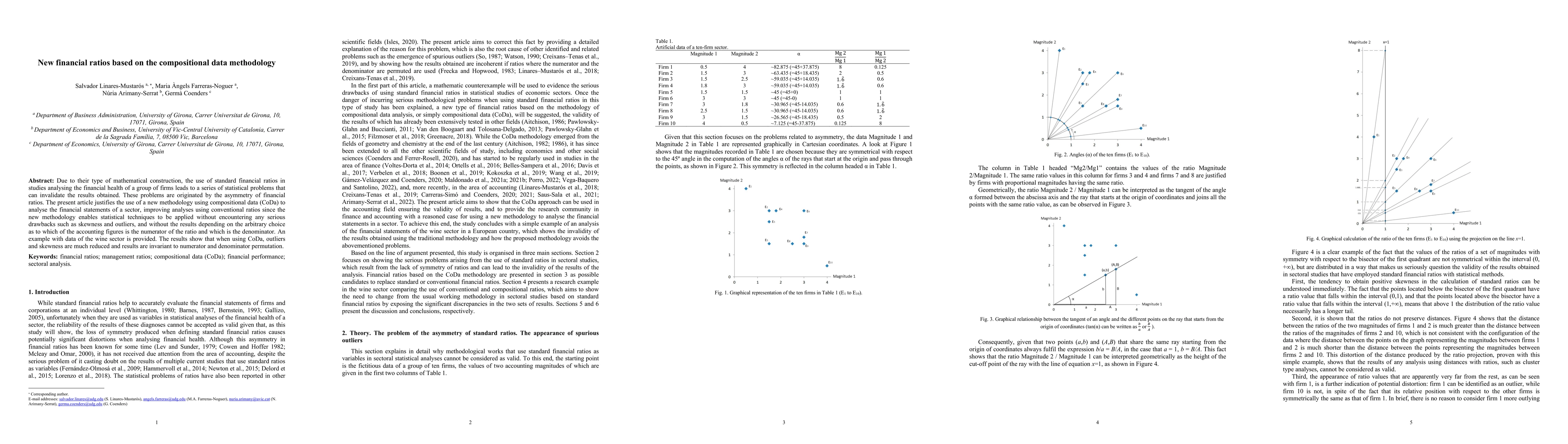

Due to their type of mathematical construction, the use of standard financial ratios in studies analysing the financial health of a group of firms leads to a series of statistical problems that can invalidate the results obtained. These problems are originated by the asymmetry of financial ratios. The present article justifies the use of a new methodology using compositional data (CoDa) to analyse the financial statements of a sector, improving analyses using conventional ratios since the new methodology enables statistical techniques to be applied without encountering any serious drawbacks such as skewness and outliers, and without the results depending on the arbitrary choice as to which of the accounting figures is the numerator of the ratio and which is the denominator. An example with data of the wine sector is provided. The results show that when using CoDa, outliers and skewness are much reduced and results are invariant to numerator and denominator permutation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe use of financial and sustainability ratios to map a sector. An approach using compositional data

Considerations on the use of financial ratios in the study of family businesses

Geòrgia Escaramís, Anna Arbussà

Ensembled Direct Multi Step forecasting methodology with comparison on macroeconomic and financial data

Tomasz M. Łapiński, Krzysztof Ziółkowski

| Title | Authors | Year | Actions |

|---|

Comments (0)