Authors

Summary

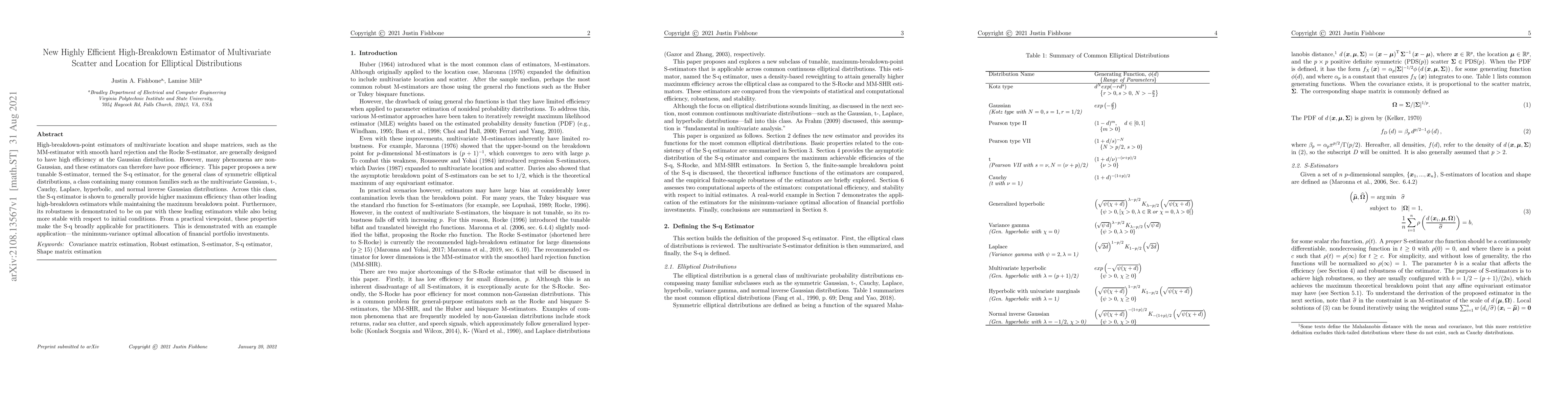

High-breakdown-point estimators of multivariate location and shape matrices, such as the MM-estimator with smooth hard rejection and the Rocke S-estimator, are generally designed to have high efficiency at the Gaussian distribution. However, many phenomena are non-Gaussian, and these estimators can therefore have poor efficiency. This paper proposes a new tunable S-estimator, termed the S-q estimator, for the general class of symmetric elliptical distributions, a class containing many common families such as the multivariate Gaussian, t-, Cauchy, Laplace, hyperbolic, and normal inverse Gaussian distributions. Across this class, the S-q estimator is shown to generally provide higher maximum efficiency than other leading high-breakdown estimators while maintaining the maximum breakdown point. Furthermore, its robustness is demonstrated to be on par with these leading estimators while also being more stable with respect to initial conditions. From a practical viewpoint, these properties make the S-q broadly applicable for practitioners. This is demonstrated with an example application -- the minimum-variance optimal allocation of financial portfolio investments.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Componentwise Estimation Procedure for Multivariate Location and Scatter: Robustness, Efficiency and Scalability

Soumya Chakraborty, Abhik Ghosh, Ayanendranath Basu

| Title | Authors | Year | Actions |

|---|

Comments (0)