Summary

We introduce a new statistical tool (the TP-statistic and TE-statistic) designed specifically to compare the behavior of the sample tail of distributions with power-law and exponential tails as a function of the lower threshold u. One important property of these statistics is that they converge to zero for power laws or for exponentials correspondingly, regardless of the value of the exponent or of the form parameter. This is particularly useful for testing the structure of a distribution (power law or not, exponential or not) independently of the possibility of quantifying the values of the parameters. We apply these statistics to the distribution of returns of one century of daily data for the Dow Jones Industrial Average and over one year of 5-minutes data of the Nasdaq Composite index. Our analysis confirms previous works showing the tendency for the tails to resemble more and more a power law for the highest quantiles but we can detect clear deviations that suggest that the structure of the tails of the distributions of returns is more complex than usually assumed; it is clearly more complex that just a power law.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

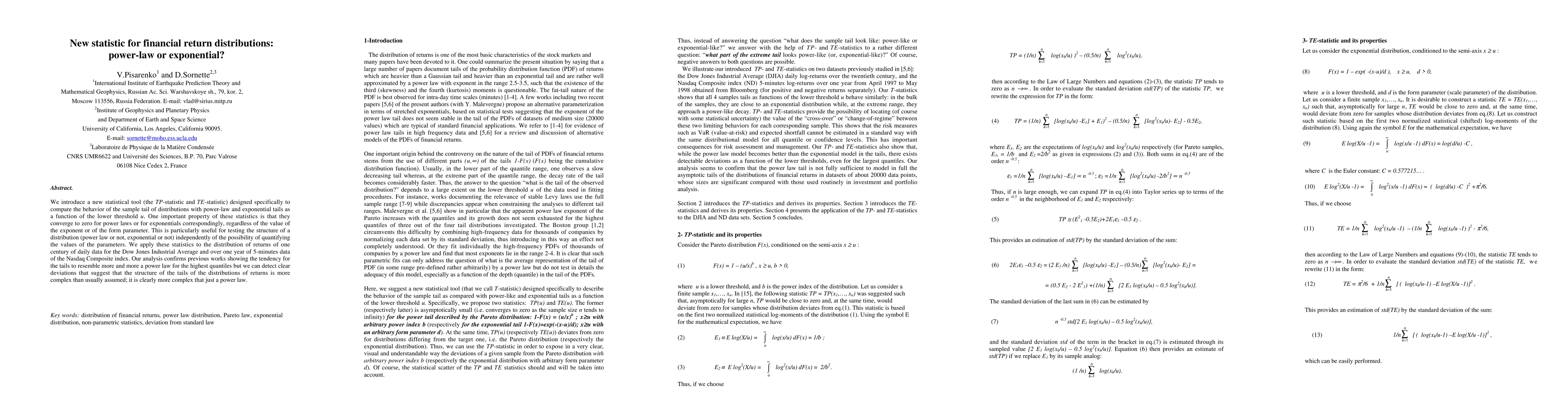

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)