Summary

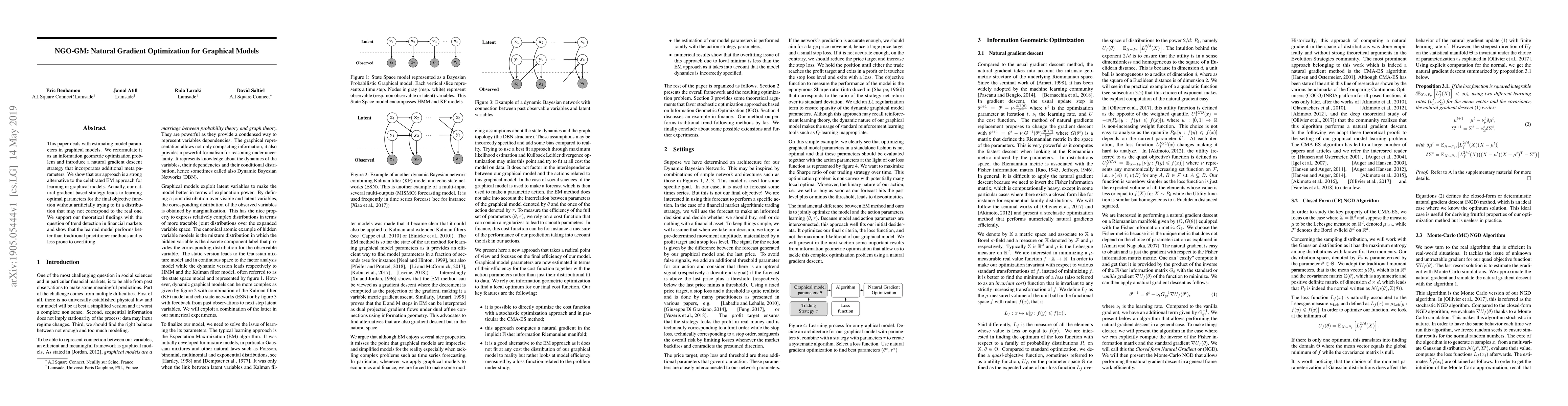

This paper deals with estimating model parameters in graphical models. We reformulate it as an information geometric optimization problem and introduce a natural gradient descent strategy that incorporates additional meta parameters. We show that our approach is a strong alternative to the celebrated EM approach for learning in graphical models. Actually, our natural gradient based strategy leads to learning optimal parameters for the final objective function without artificially trying to fit a distribution that may not correspond to the real one. We support our theoretical findings with the question of trend detection in financial markets and show that the learned model performs better than traditional practitioner methods and is less prone to overfitting.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)