Summary

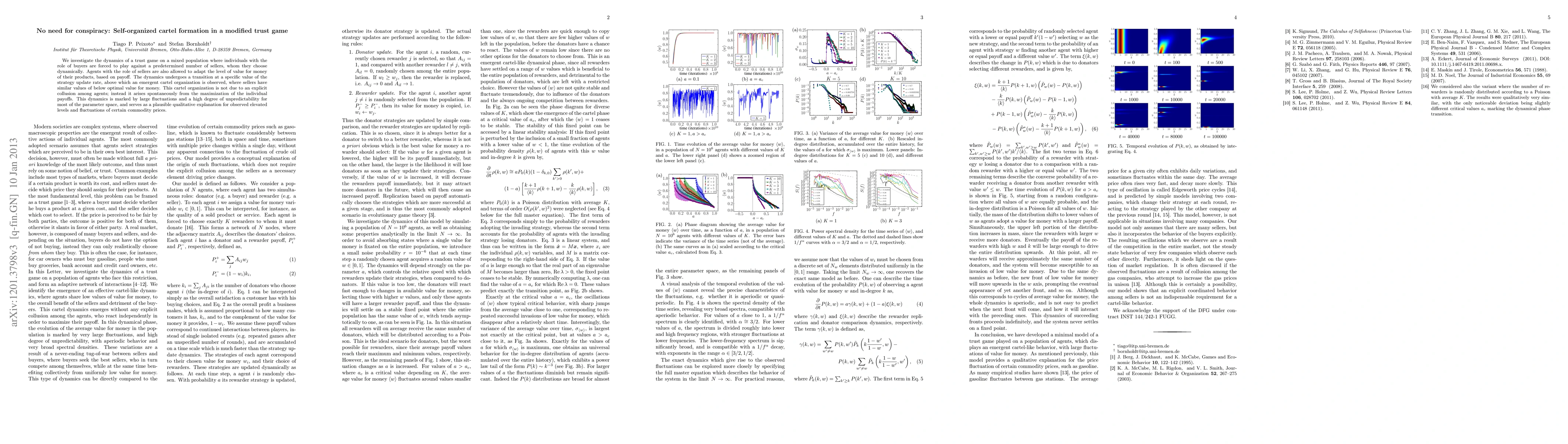

We investigate the dynamics of a trust game on a mixed population where individuals with the role of buyers are forced to play against a predetermined number of sellers, whom they choose dynamically. Agents with the role of sellers are also allowed to adapt the level of value for money of their products, based on payoff. The dynamics undergoes a transition at a specific value of the strategy update rate, above which an emergent cartel organization is observed, where sellers have similar values of below optimal value for money. This cartel organization is not due to an explicit collusion among agents; instead it arises spontaneously from the maximization of the individual payoffs. This dynamics is marked by large fluctuations and a high degree of unpredictability for most of the parameter space, and serves as a plausible qualitative explanation for observed elevated levels and fluctuations of certain commodity prices.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHow to Use Data Science in Economics -- a Classroom Game Based on Cartel Detection

Hannes Wallimann, Silvio Sticher

| Title | Authors | Year | Actions |

|---|

Comments (0)