Summary

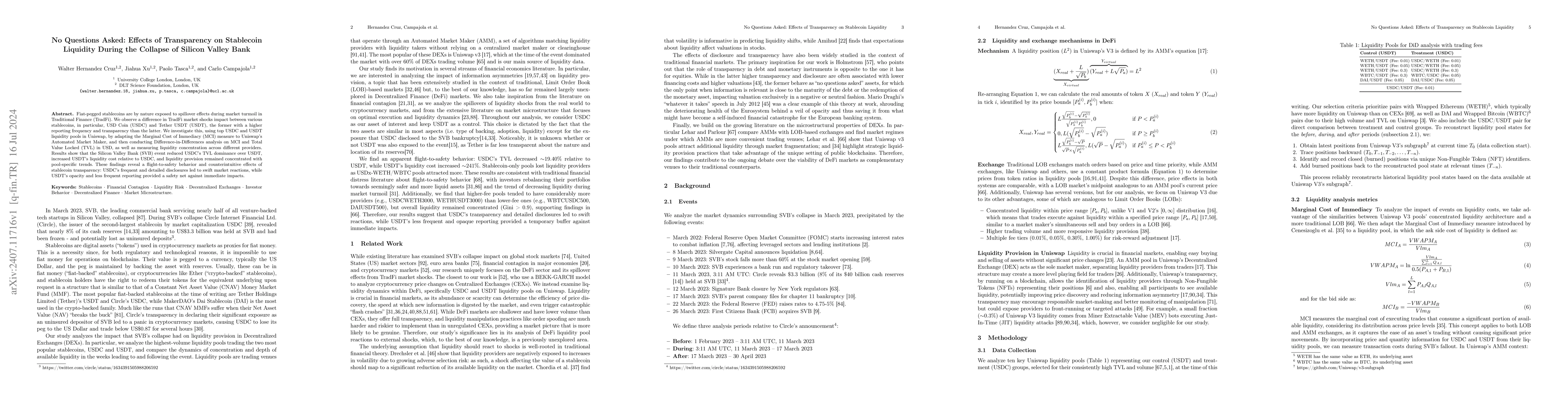

Fiat-pegged stablecoins are by nature exposed to spillover effects during market turmoil in Traditional Finance (TradFi). We observe a difference in TradFi market shocks impact between various stablecoins, in particular, USD Coin (USDC) and Tether USDT (USDT), the former with a higher reporting frequency and transparency than the latter. We investigate this, using top USDC and USDT liquidity pools in Uniswap, by adapting the Marginal Cost of Immediacy (MCI) measure to Uniswap's Automated Market Maker, and then conducting Difference-in-Differences analysis on MCI and Total Value Locked (TVL) in USD, as well as measuring liquidity concentration across different providers. Results show that the Silicon Valley Bank (SVB) event reduced USDC's TVL dominance over USDT, increased USDT's liquidity cost relative to USDC, and liquidity provision remained concentrated with pool-specific trends. These findings reveal a flight-to-safety behavior and counterintuitive effects of stablecoin transparency: USDC's frequent and detailed disclosures led to swift market reactions, while USDT's opacity and less frequent reporting provided a safety net against immediate impacts.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersContagion Effects of the Silicon Valley Bank Run

Paul Goldsmith-Pinkham, Dong Beom Choi, Tanju Yorulmazer

Atomic collapse in gapped graphene: lattice and valley effects

Jing Wang, Yue Hu, Francois M. Peeters et al.

No citations found for this paper.

Comments (0)