Authors

Summary

We introduce the application of online learning in a Stackelberg game pertaining to a system with two learning agents in a dyadic exchange network, consisting of a supplier and retailer, specifically where the parameters of the demand function are unknown. In this game, the supplier is the first-moving leader, and must determine the optimal wholesale price of the product. Subsequently, the retailer who is the follower, must determine both the optimal procurement amount and selling price of the product. In the perfect information setting, this is known as the classical price-setting Newsvendor problem, and we prove the existence of a unique Stackelberg equilibrium when extending this to a two-player pricing game. In the framework of online learning, the parameters of the reward function for both the follower and leader must be learned, under the assumption that the follower will best respond with optimism under uncertainty. A novel algorithm based on contextual linear bandits with a measurable uncertainty set is used to provide a confidence bound on the parameters of the stochastic demand. Consequently, optimal finite time regret bounds on the Stackelberg regret, along with convergence guarantees to an approximate Stackelberg equilibrium, are provided.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

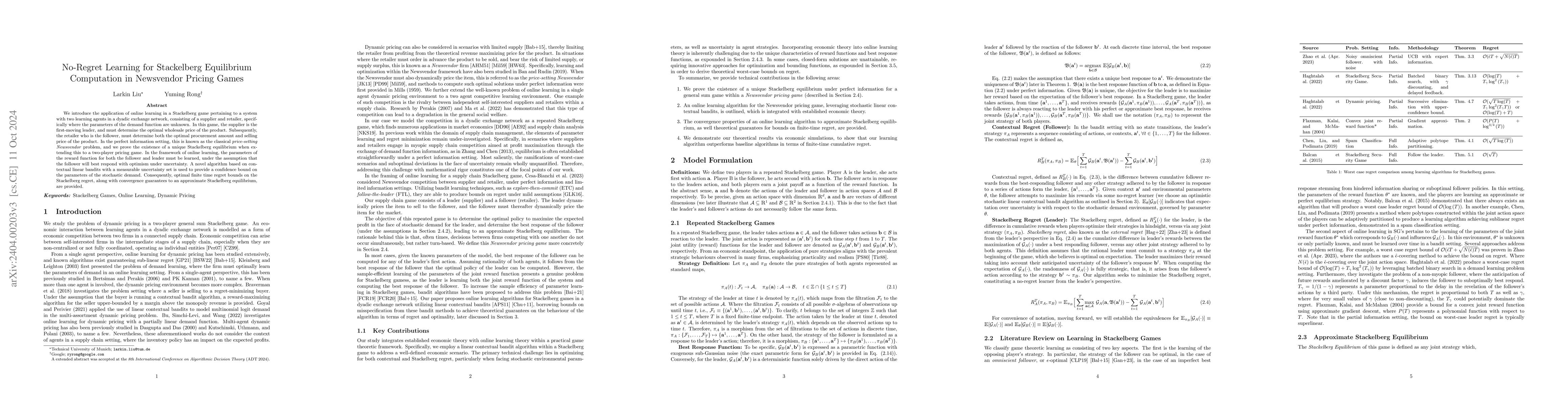

Found 4 papersRobust No-Regret Learning in Min-Max Stackelberg Games

Jiayi Zhao, Denizalp Goktas, Amy Greenwald

No-Regret Learning in Dynamic Stackelberg Games

Mahsa Ghasemi, Abolfazl Hashemi, Ufuk Topcu et al.

ReLExS: Reinforcement Learning Explanations for Stackelberg No-Regret Learners

Jingyuan Li, Jiaqing Xie, Xiangge Huang

No-Regret Learning in Stackelberg Games with an Application to Electric Ride-Hailing

Nikolas Geroliminis, Maryam Kamgarpour, Marko Maljkovic et al.

No citations found for this paper.

Comments (0)