Summary

We establish a generalization of Noether theorem for stochastic optimal control problems. Exploiting the tools of jet bundles and contact geometry, we prove that from any (contact) symmetry of the Hamilton-Jacobi-Bellman equation associated to an optimal control problem it is possible to build a related local martingale. Moreover, we provide an application of the theoretical results to Merton's optimal portfolio problem, showing that this model admits infinitely many conserved quantities in the form of local martingales.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

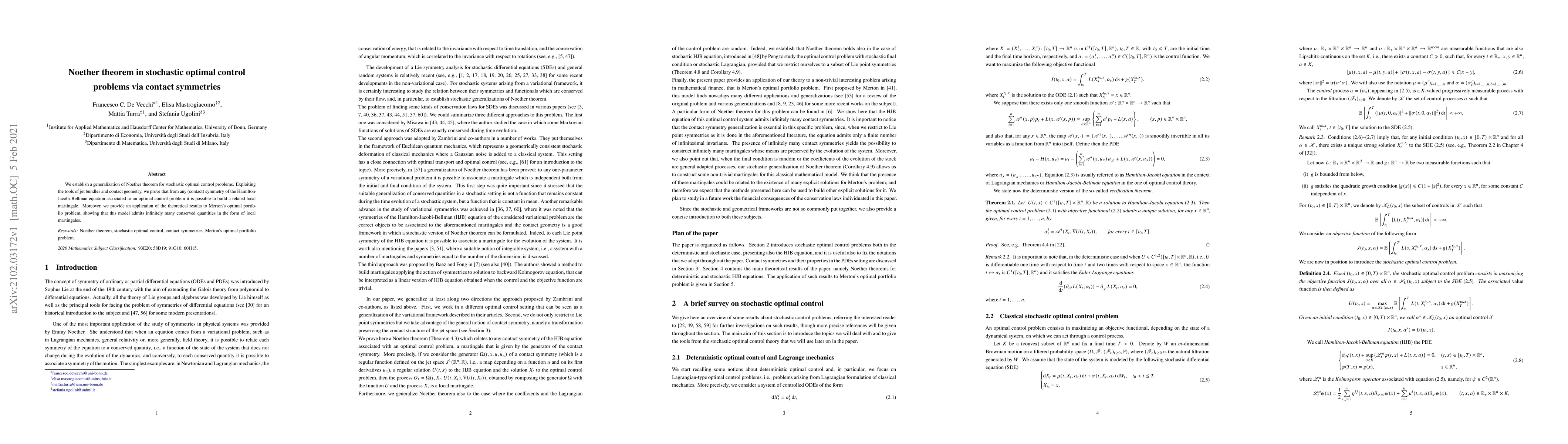

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTrim turnpikes for optimal control problems with symmetries

Kathrin Flaßkamp, Sofya Maslovskaya, Sina Ober-Blöbaum et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)