Summary

We consider non-concave and non-smooth random utility functions with do- main of definition equal to the non-negative half-line. We use a dynamic pro- gramming framework together with measurable selection arguments to establish both the no-arbitrage condition characterization and the existence of an optimal portfolio in a (generically incomplete) discrete-time financial market model with finite time horizon. In contrast to the existing literature, we propose to consider a probability space which is not necessarily complete.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

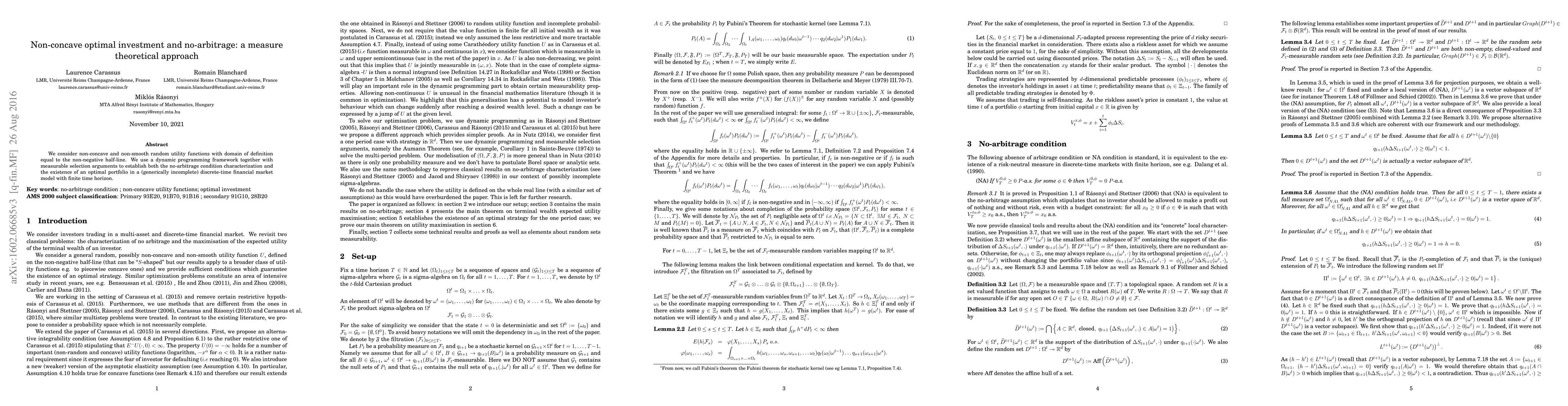

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)